A notification was recently sent out by Manulife regarding changes to their Healthstyles® program

Manulife’s announcement follows a strong trend in the industry towards automated underwriting. This became very popular in the early 1990’s, however, this comes with challenges to the insurance companies and to brokers. Preferred rates can put a squeeze on profitability and be challenging for brokers to explain to clients. Many on-line software tools use preferred rates as a default rate to lure consumers but most consumers don’t qualify for preferred rates and there can be many different tiers of preferred rates. This often creates a frustration for the broker and consumers who don’t qualify.

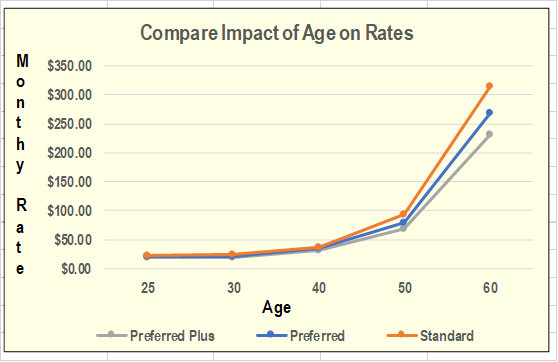

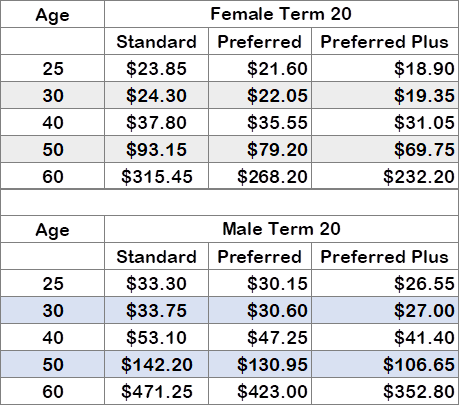

Having said that, as noted by independent broker Richard Parkinson preferred rates can offer consumers substantial savings over standard life insurance rates. Richard AKA Mr. Spreadsheet offered the charts below as examples:

Richard also had this to say,

“Canada Life has also eliminated the preferred (middle) category for $1M or less. Several other companies, e.g. Assumption Life, Humania, Western Life, etc. never offered preferred rates, based on they felt their rates were competitive enough already. Manulife stated in their announcement that this change was due to accelerated underwriting, which seems to automate the decision as much as possible, focus on lifestyle more, and minimize the expense of paramedicals and lab tests when the monthly premium is small to begin with. Underwriting 3 rate categories rather than one is a lot more expensive, and I believe it is a trend that will continue. Manulife is also a trend setter, so when they introduce a fundamental change, many other companies soon follow suit. Lastly there seems to also be a trend by several companies to do more direct to consumer web-based marketing of life insurance, so they want to keep it as simple as possible. Unfortunately, this direct web-based marketing is not in the best interest of most consumers, and is typically more expensive for the consumer than dealing with a broker“

Here is what some other industry experts had to say about the issue and whether preferred rates may be on their way out and how this may impact consumers:

Lawrence Ian Geller, President of L.I. Geller Insurance Agencies and Founder of ForAdvisorsOnly.com

“It certainly saves insurance companies that use it a great deal (as it does with mortgage, creditor and association / affinity sales).

Assume that underwriting a policy with a human underwriter costs $75 – $300 for simple cases.

Assume that underwriting a policy with Automated Underwriting (AI) costs $5 – $15 for simple cases.

Assume that any complicated cases are declined or rated automatically by AI at no increased costs.

Assume that any complicated cases are reviewed for a decision when u/w by a human at an additional cost of $X.

Assume that 2% of all term policies result in claims and that all policies that had been underwritten by AI are then reviewed by a human and that the insurance company’s first position for any potential undisclosed item is to decline or vitiate ab initio.

Assume that only those term policies that result in claims that had been issued in the 24 preceding months are reviewed and that the company’s first position is to honour the claim.

(all assumptions are completely arbitrary)

This may be seen to be alarmist by those insurance companies and Fintech companies that advocate this form of u/w, but from the perspective of a consumer they might be real concerns. After all, people buy insurance so that if their beneficiaries have to claim they are paid without question, not just so that they can pay a premium.

And then there are the Privacy and Big Data Issues associated with AI underwriting, the potential for those databases to be hacked.”

Ben Therrien, Independent Broke with Zoobla Financial

Great-West, London and Canada Life are in the process of launching a new faster issue service called Simple Protect that will be rolling out to the market in the next few months and this streamlines the process. You will likely see more and more of this and the trade-off is less underwriting. While there is no change to pricing at the moment, if you are watcher of the industry, you could imagine that the future will be some slightly different pricing for a better client and Advisor experience.