Simplified Life Insurance (or also called Simplified Issue Life Insurance) is a type of No Medical Life Insurance that comes WITHOUT medical exams but STILL CAN HAVE SOME QUESTIONS that you need to answer. An applicant has reply these truthfully. Simplified issue life insurance offers premiums higher than Standard Life Insurance (also called Traditional Life Insurance) but lower than Guaranteed Life Insurance and higher levels of insurance protection.

Simplified Life Insurance is often seen as the least expensive type of No Medical Life Insurance. It has some limitations on maximum insurance coverage limits, and the benefit typically ranges from $100K to $500K.

IMPORTANT: It is important to understand if your policy comes with an “immediate claim payouts”. An immediate claim payout means that an insurance claim can be submitted even if a policyholder passes away immediately after getting a life insurance policy. A policy with “deferred payouts” will not pay a death benefit within the first one or two years. These options depend on the policy’s specific conditions, and these options also affect the premium.

There are numerous reasons when it makes sense to consider Simplified Issue Life Insurance. Typically, they are following:

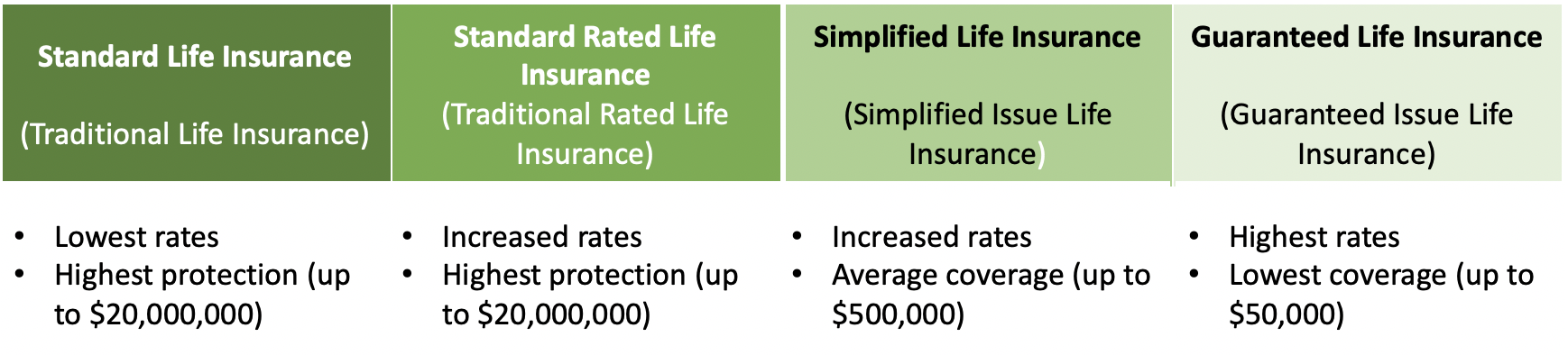

Here is a brief comparison of how Simplified Issue Life Insurance compare to other insurance products:

| Standard Life Insurance | Standard Rated Life Insurance | Simplified Issue Life Insurance | Guaranteed Issue Life Insurance | |

| Medical exam / fluids | Yes | Yes | No | No |

| Medical Questionnaire | Yes | Yes | Yes | No |

| Considered No Medical? | No | No | Yes | Yes |

| Coverage | Up to $20,000,000 | Up to $20,000,000 | Up to $500,000 | Up to $50,000 |

| Waiting period of 2 years | No | No | Maybe | Yes |

| Life insurance rates | The cheapest rates | More expensive than Standard Life Insurance | Less expensive than Guaranteed Issue Life Insurance | The most expensive rates |

Below are a few examples of different 20 year life insurance rates/quotes. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on your health condition).

Female, 35 years old, 20 Year Life Insurance Term, Non-Smoker, coverage amount $1,000,000

Female, diabetes pre-condition, 35 years old, 20 Year Life Insurance Term, Non-Smoker, coverage amount $500,000

Female 35 years old, cancer diagnosis, 20 Year Life Insurance Term, Non-Smoker, coverage amount $300,000

Yes, you can get life insurance without a physical exam. This type of insurance is called no medical life insurance. It comes either with a medical questionnaire (simplified life insurance) or without any questions asked (guaranteed life insurance). No medical life insurance coverage limits are lower than traditional life insurance and a no medical life insurance policy costs more (for the same amount of coverage).

No medical exam life insurance is a type of life insurance that does not require medical tests (also called simplified issue life insurance). Some no medical life insurance types go even further and do not even require a medical questionnaire (also called guaranteed issue life insurance).

This is a great insurance choice for those who would not be approved for traditional (also called standard) life insurance, which comes with medical tests and a questionnaire to complete. Our insurance experts will help you with all of your no medical life insurance choices.