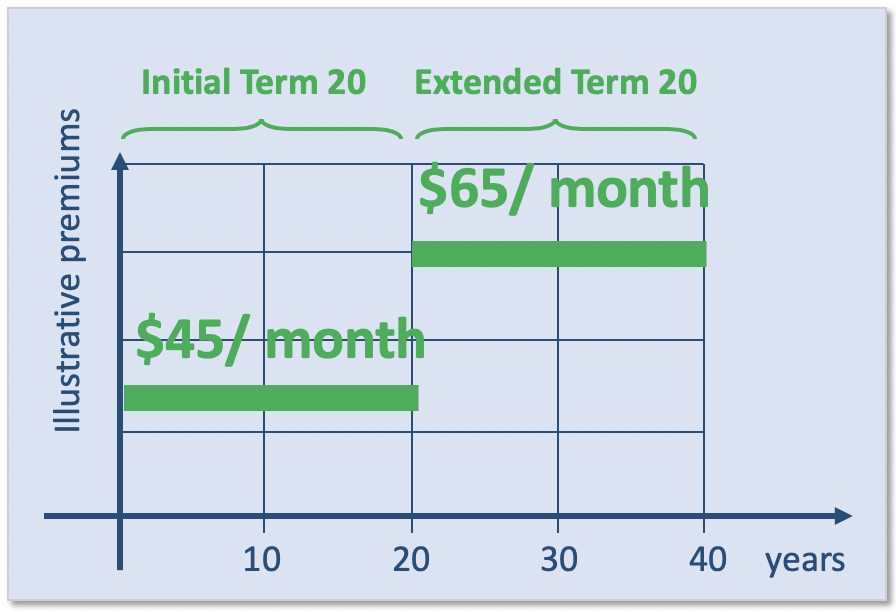

Term 20 life insurance is a sub-category of Term life insurance. It covers a policyholder for a clearly defined term of 20 years (thus, it is called Term 20). Should a policy holder pass away within this time frame, his/her beneficiaries will receive the coverage amount. After 20 years, this policy comes to an end (coverage disappears). A picture below shows a sample premium structure.

If you want to extend a 20 year term life insurance policy, most likely, your insurance company will require you to get another quote. The new term life insurance policy will be typically more expensive because life insurance rates become higher as you get older (see an example below).

20 year level term life insurance, or Term 20 Life Insurance, provides a coverage for 10 years only and is optimal in particular situations. Here are a few examples:

Here is a brief comparison of how 20 year term life insurance compares to whole life insurance and universal life insurance.

| 20 Year Term Life Insurance | Whole Life Insurance | Universal Life Insurance | |

| Coverage length | 20 year coverage | Life long | Life long |

| Insurance coverage | Yes | Yes | Yes |

| Cash accumulation | No | Yes | Yes |

| Can choose amounts going into insurance and cash accumulation | No | No | Yes |

| Pricing | Lower than Whole Life and Universal Life | More expensive than Term Life | More expensive than Term Life |

Below are a few examples of 20 year term life insurance rates/quotes. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on your health condition).

Male, 29 years old, 20 Year Life Insurance Term, Non-Smoker, coverage amount $250,000

Female, 36 years old, 20 Year Life Insurance Term, Non-Smoker, coverage amount $400,000

Female 47 years old, 20 Year Life Insurance Term, Non-Smoker, coverage amount $350,000

The insurance rates presented are effective as of August 2025.

Below are a few examples of 10 and 20 year term life insurance quotes for $300,000 coverage. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on your health condition).

| 20 Year Term Life Insurance rates | 30 Year Term Life Insurance rates | |

| Male, 25 years old, non-smoker | $19 / month | $26 / month |

| Female, 25 years old, non-smoker | $14 / month | $18 / month |

| Male, 40 years old, non-smoker | $30 / month | $58 / month |

| Female, 40 years old, non-smoker | $23 / month | $43 / month |

The insurance rates presented are effective as of August 2025.

Please find below a few examples of 10 and 20 year term life insurance quotes for $500,000 coverage. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on health condition).

| 10 Year Term Life Insurance rates | 20 Year Term Life Insurance rates | |

| Male, 30 years old, non-smoker | $20 / month | $30 / month |

| Female, 30 years old, non-smoker | $14 / month | $20 / month |

| Male, 50 years old, non-smoker | $61 / month | $120 / month |

| Female, 50 years old, non-smoker | $45 / month | $81 / month |

The insurance rates presented are effective as of August 2025.

Term 20, or 20 year term life no medical exam insurance, is a subset of no medical term life insurance. It is a version of life insurance that does not require medical tests (also called simplified issue life insurance). Some no medical life insurance types go even further and do not even require a medical questionnaire (also called guaranteed issue life insurance).

This is a great insurance choice for those who would not be approved for traditional (also called standard) life insurance, which comes with medical tests and a questionnaire to complete. Our insurance experts will help you with all of your no medical life insurance choices.

1. Term 20 means that the premiums are level for the first 20 years of the policy. This is true for virtually all term plans; some companies did offer policies that gave them an option to adjust the premium during a policy year, but generally speaking, the premium remains level for the first two decades of most plans.

2. Beware of the renewal premium. Some companies offer a lower initial premium than their competitors but offer a much higher renewal premium. The renewal premium should be kept in the back of your mind because even in the best case scenarios, renewal premiums on a Term 20 are up to ten times higher than the original premium, which makes it highly unlikely that most people will keep a Term 20 policy past its renewal.

3. Make sure the policy is convertible. Most Term 20 policies in Canada are convertible to permanent plans without a medical, but, some companies do not offer conversion for their Term 20 Plans.

4. Choose a Term 20 carrier that offers preferred rates. Preferred rate plans are given to individuals in very good health who have a very good family health history. If you qualify for preferred rates, it could mean up to a 30% savings.

5. Shop around. Term 20 rates can vary widely between companies, make sure to get insurance quotes from several companies. For example, our insurance brokers work with 20+ Canadian life insurance companies and can help you to get the best Term 20 life insurance rates.