Guaranteed Life Insurance (or also called Guaranteed Issue Life Insurance) is a type of No Medical Life Insurance that comes WITHOUT medical exams and WITHOUT medical questions that you need to answer. Everybody can qualify for this insurance type. Guaranteed Issue Life insurance premiums significantly higher than any other life insurance rates.

Simplified Life Insurance is often seen as the most expensive type of No Medical Life Insurance. It has some limitations on maximum insurance coverage limits, and the benefits go up to $50,000.

IMPORTANT: It is important to understand that guaranteed issue life insurance policies come with “deferred payouts” meaning that these policies will not pay a death benefit within the first one or two years.

There are numerous reasons when it makes sense to consider Simplified Issue Life Insurance. Typically, they are following:

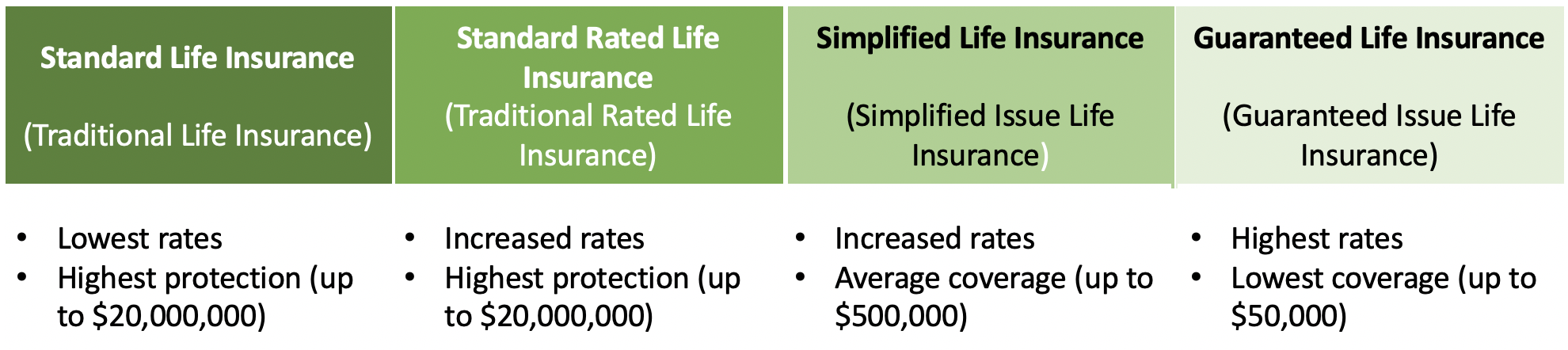

Here is a brief comparison of how Guaranteed Issue Life Insurance compare to other insurance products:

| Standard Life Insurance | Standard Rated Life Insurance | Simplified Issue Life Insurance | Guaranteed Issue Life Insurance | |

| Medical exam / fluids | Yes | Yes | No | No |

| Medical Questionnaire | Yes | Yes | Yes | No |

| Considered No Medical? | No | No | Yes | Yes |

| Coverage | Up to $20,000,000 | Up to $20,000,000 | Up to $500,000 | Up to $50,000 |

| Waiting period of 2 years | No | No | Maybe | Yes |

| Life insurance rates | The cheapest rates | More expensive than Standard Life Insurance | Less expensive than Guaranteed Issue Life Insurance | The most expensive rates |

Below are a few examples of different 20 year life insurance rates/quotes. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on your health condition).

Male, 50 years old, non-smoker, coverage amount $25,000

Female, 60 years old, non-smoker, coverage amount $25,000

Female, 70 years old, non-smoker, coverage amount $25,000

When you buy Guaranteed Issue Life insurance (e.g. if you have serious health pre-conditions), you do not need to worry about any medical exams or medical questions. Your guaranteed issue life insurance rates will be higher than for any other life insurance types due to a higher risk. It is important to know that if you pass away during the first two years, your life insurance policy will not pay a death benefit.

Meanwhile, most life insurance companies in Canada offer Guaranteed Life Insurance policies including the largest insurers such as Manulife, Canada Life, Sun Life and many others and many smaller ones such as RBC Insurance, Canada Protection Plan, Empire Life, Assumption Life and many others

As mentioned earlier, guaranteed issue life insurance policies are available without a medical and with no health questions. One big caveat with guaranteed issue life insurance is that if the insured passes away in the first two years by a non-accidental death, the death benefit is usually limited to a return of premium. Some companies do offer interest on the return of premium, while others don’t.