Whole life insurance is a great option for some people, but it may not be the right choice for everyone. Some people believe the advantages far outweigh the disadvantages, while others believe just the opposite.

Whole life insurance is a great option for some people, but it may not be the right choice for everyone. Some people believe the advantages far outweigh the disadvantages, while others believe just the opposite.

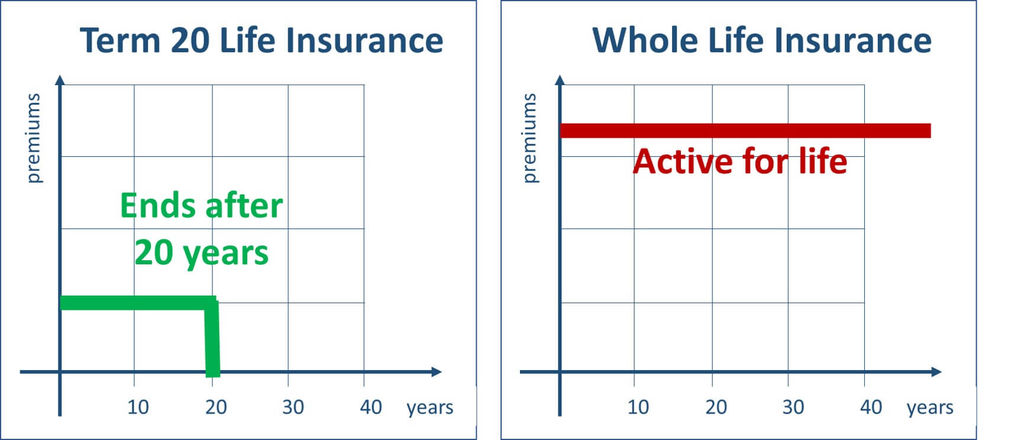

What is whole life insurance? It is a life insurance policy that insures you as long as you live. It is both a life insurance and savings product – this policy accumulates value that you can get, either when you surrender policy (i.e. end the policy) or if you decide to borrow against the policy value.

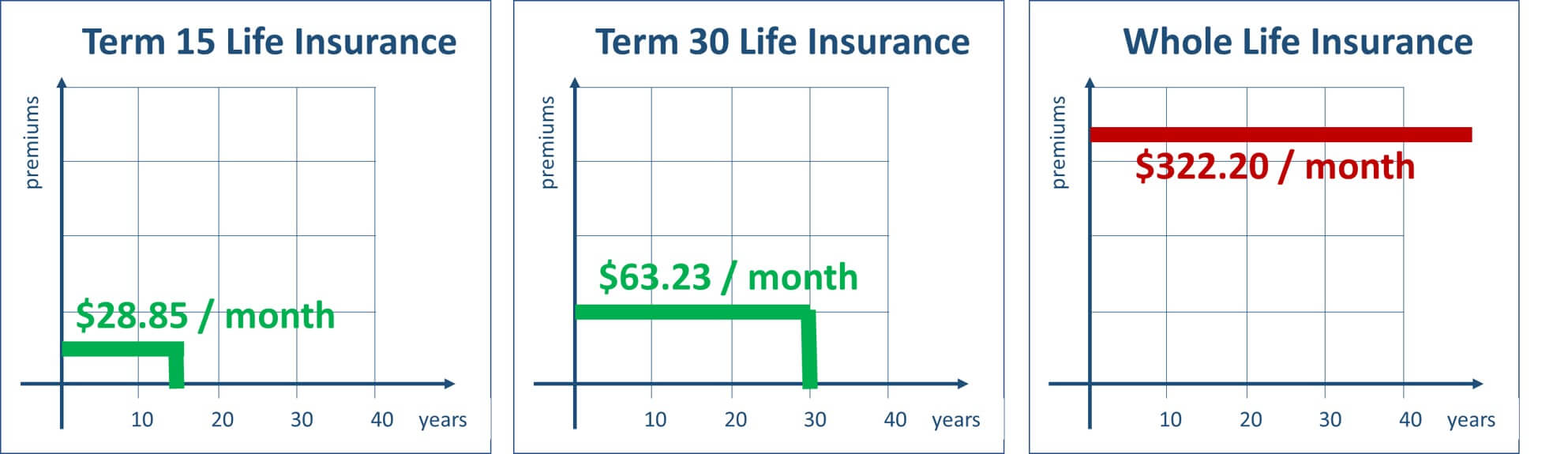

Typically, a whole life insurance is more expensive than term life insurance because it covers you through the whole life without premium changes and has additional features (e.g. cash accumulation). Here are a few whole life quoting examples – rates are from September 2018.

|

Policyholder: 35 years old male, non-smoker, no serious health issues |

Policyholder: 35 years old female, non-smoker, no serious health issues |

Policyholder: 45 years old male, non-smoker, no serious health issues |

Policyholder: 45 years old female, non-smoker, no serious health issues |

|

$137.70/month |

$122.22/month |

$214.38/month |

$180.54/month |

Here are some pros and cons of whole life insurance to help you decide if it may be the right choice for you.

Your policy can be used as an investment and be part of your overall estate plan. A portion of premiums you pay go towards a cash fund. This fund grows over time and will be paid out tax-free, along with the value of the policy.

Your premiums stay the same for the rest of your life. Your premiums will never go up for as long you own your policy.

A whole life insurance policy can actually be paid up, which means you don’t go on paying premiums forever. With these limited pay periods, you can have coverage for as long as you live, without any premiums to pay after retirement when your income might be considerably lower.

You can choose a participating or non-participating life insurance policy. A participating policy allows you to receive dividends on investments made by the insurance company while a non-participating policy does not.

A whole life insurance policy does not need to be renewed, which means premiums never go up. Other policy premiums increase as you get older.

Whole life insurance is permanent insurance coverage. The policy will stay in effect as long as premiums are paid on time.

The death benefit and premiums are both guaranteed. Some policies guarantee one or the other, but not both. Whole life insurance has more guarantees than other types of policies.

Whole life insurance policies offer a range of living benefits that won’t deplete the death benefit.

Can be used as a form of savings with huge growth potential and tax advantages. The cash value portion is guaranteed to be paid.

Your money is not lost. Should you choose to cancel your policy, you will receive the cash value portion accumulated by your policy.

You can use some of the cash value portion of your policy to pay your premiums and convert your policy to a “paid up” policy.

You don’t have to risk the capital of your policy even though it is invested in a pool of assets that may change in value.

You can leave an inheritance for your grandchildren. Since the policy lasts for as long as you live, the tax-free lump sum doesn’t have to go for expenses such as mortgage, cost of living, income replacement or other expenses normally associated with term life policies. You can spend all of your retirement savings and still leave something for your loved ones.

Good fit for retirees because they don’t need coverage for debts, mortgages or income replacement.

Many people find they can’t afford the premiums after a few years and end up cancelling before building up any cash value. The Society of Actuaries found that 20% of whole-life policies are terminated in the first three years and 39% within the first 10 years.

It takes time for cash value to build. Very little of premiums during the first few years go into the cash portion of the account.

During the first year a large portion of the premium is given to the advisors as their commission, prompting them to sell more whole life policies, which might not always be in the best interest of the client.

More than half of the premium for the first year goes to the insurance agent or advisor and a large portion goes to the insurance company to cover death benefits, leaving very little for the cash value portion of the policy. This means that you should carefully consider the amount of coverage and not the return on your investment unless the policy is for investment or estate planning purposes only.

Whole life insurance policies are not designed for short term needs. Although it is a good idea to purchase a whole life policy when you are young, it is not the type of policy a young family can normally afford.

A whole life policy is not designed for short-term expenses. A term policy might be better to cover a mortgage, funeral expenses or income replacement in case of an untimely death because coverage may not be needed after these expenses are paid.

In most cases, a term policy will provide adequate insurance coverage, so there is no need to spend the extra money for a whole life policy.

A whole life policy is extremely complex. You need an experienced advisor to explain all of your options and to help you decide what you need. A term policy is very simple, inexpensive and quite adequate for the average person.

The growth on investment of a whole life policy may be much less than if you invest the money yourself.

Generally speaking, you don’t have a choice about changing any aspect of your whole life policy.

A whole life policy is very inflexible compared to other types of life insurance. You may never know how your premium is being used or how much of the premium is actually applied to the death benefits or the amount of the premium going towards the cash value portion.

A whole life policy doesn’t allow you to suggest investment opportunities. You have no say in how your money is being invested.

Significant fees may be charged for handling the investment portion of your insurance policy.

You may not need coverage for your entire life. As your life changes, your insurance needs may change as well, making a term policy the more practical choice.

We hope you found this overview helpful. Should you have further questions to this topic, please do not hesitate to reach out to our experienced whole life insurance brokers who work with more than 20 Canadian life insurance providers to get you the best rate.