Whole life insurance has tax saving efficiencies, but those efficiencies are often very misunderstood. To gain an understanding on how best to leverage your savings in a tax-sheltered whole life insurance policy, we talked to Cory Budovitch, Owner of Budovitch Legacy Planners Inc. and Brent Swatuk, Advanced Case Consultant at Equitable Life. Both of these men are highly respected in Canada’s financial services industry and they love helping Canadian entrepreneurs minimize tax and maximize investments.

Term life insurance is known as a “pure” insurance product. That means, it offers coverage for a set amount of time, and nothing else. Whole life insurance, however, offers a savings component. Part of the premiums that you pay flow over into a savings portion, and those savings grow with interest tax free – providing you do not cross what is known as the MTAR (maximum tax accrual rules) limit. Your life insurance agent or broker is contractually obligated to ensure your investments do not exceed this limit.

This is the difference between term and whole life insurance when it comes to tax relevance. Term will not provide any extra tax incentive while whole life adds a layer to tax protection while also providing lifelong coverage. For many people, the extra premium costs of whole life make these attractive features worth the investment.

The main draw of whole life insurance, besides it being a policy that never needs to be renewed, is how it functions as an investment with dividends. Typically, whole life insurance cash values grow at rates between 5%-8% for the duration of the policy. The investment mix is typically very stable; one insurance company has returned a positive dividend for over 165 years straight! It’s a great low-risk product that allows the policy owner a great deal of control and consistency.

So, what happens if you like the attributes of whole life insurance but don’t want to pay for a policy for your entire life? You have the option of paying a little more on the premium in exchange for paying up the policy earlier.

As you can see, this is a fairly complicated insurance product. In order to maximize your investment, not cross the MTAR limit, and to have access to your cash reserves, it is vital to choose an advisor that understands all of this product’s many nuances.

Let’s take a closer look at the tax advantages of whole life insurance.

In Canada, our government allows us to contribute about 10 times the premium into the tax-free investment portion and when certain strategies are leveraged, you can withdraw the funds tax free as well (discuss this strategy with your advisor).

One of the greatest factors to look out for is the erosion of your investments due to tax, as tax plays a massive role in how fast your investment will ultimately grow. Again, this can be managed with the right strategy and overseen by the right advisor.

Despite some things to watch out for, there is no other investment on the market that allows for such large tax-free contributions.

It’s not just individuals that benefit from whole life insurance and the tax advantages it offers. This is a great product for corporations too.

Whole life insurance, when paid for by corporate dollars, means you do not need to take income and pay income tax, and then invest. The product is a corporate investment, to be paid for with corporate dollars, but it can still be passed along to loved ones tax free (under certain, strategic scenarios).

Additionally, this type of insurance, when owned by a corporation, creates a capital dividend account which is a notional account and tax credit that can be used to offset other corporate tax owed upon death. Any corporate business owner that will owe tax amassed from marketable securities, RRSPs, company shares and/or secondary residences would be wise to leverage this strategy to reduce their final tax burden.

Levelizing the tax for corporations is a strategy to recapture the lost wealth that is being transferred away from a corporation. In most cases, the corporation doesn’t realize where the money is being lost.

Consider this scenario.

A business owner, let’s call him Joe, has worked very hard and assumed a lot of risk to get his business up and running. Now Joe is seeing and retaining profit on a regular basis. We know that Joe takes risk in his business because he feels comfortable that he can control many of the risk factors in order to achieve a great return on his time, energy and efforts.

So, how can Joe make his money work harder for him so he can relax a little and reap the rewards of his hard work and risk assumption?

As advisors, we come across a lot of fixed income investments inside of operating or holding companies and that’s just a really punitive place to hold retained earnings. Under this model, Joe is receiving a nominal or very low rate of return and is getting mugged in taxes at 50.17%!

Joe, like most hardworking business owners, is heavily invested in driving his business and is mindful and balance-sheet focused on his passive investments. When the closing balance of the investment is larger than the opening balance, Joe feels like he is making progress.

Typically, Joe would then pay the taxes owing on the annual return out of the earnings and the balance gets reinvested into the fixed income. Sound reasonable? Remember, what Joe is looking at is the opening, then the closing and ensuring that balance has increased, however what this ignores is the wealth he transferred away to the tax man, and especially the lost opportunity of not being able to invest or earn on that transferred wealth.

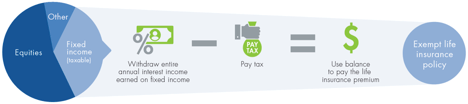

For clients like Joe we introduce the levelized tax strategy. What the client is going to do is take the net annual after-taxes-paid returns and instead of reinvesting it back into the fixed income investment, they’re going to place it into another vehicle, namely, our high early value whole life insurance policy.

The whole life policy provides an environment that is extremely friendly to the client’s balance sheet, as the cash value builds within the policy, it’s tax deferred, it reduces the annual tax bill, and it provides an increase to the business owners estate. Over time you see that less is transferred away in tax and the business owner’s balance sheet is bolstered with cash surrender value (CSV) that provides and promotes liquidity, use, and control. The CSV can be easily put back into the business if required to shore up cash needs into crisis or take advantage of opportunities in business/real estate/etc.

If the business owner were to pass away, the whole life policy really shows its brilliance versus the alternative fixed income model, as it provides a multiplier over what was deposited versus what can traditionally be achieved through the alternative investment scenario. This life insurance is unique as it gives rise to a credit in the company’s capital dividend account balance and allows most, if not all, of that capital to be paid out tax free to the beneficiaries.

For CEOs like Joe, this strategy can maximize their hard work and investments, giving them more financial rewards for business acumen and greater financial security for their beneficiaries.

Let’s examine another example in greater detail.

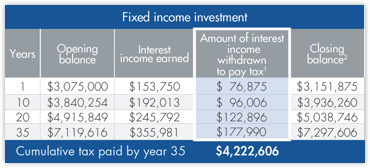

With a $3.075 million opening balance in year 1, the age 85/ year 35 balance of $7,297 million looks like a total balance sheet winner, but this completely ignores the $4.222 million dollars of tax payable and the lost opportunity cost.

Reposition the net annual return into a whole life insurance policy.

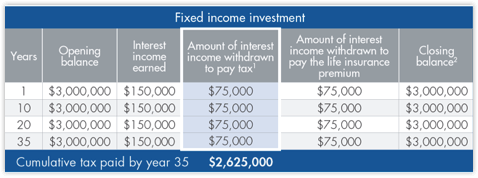

We deposit the first $75K into the whole life insurance policy up front leaving $3 million, and we reposition the $75K after tax into the policy annually. From a balance sheet perspective, the above chart looks like a loser as you start with $3 million and end with $3 million but remember that we need to take into consideration the CSV and estate benefits of the Whole Life policy. Also notice the tax column shows $2.625 million payable in tax under this scenario, which is an approximate $1.6 million reduction in tax owing.

Here’s another way to look at the tax benefits of a whole life insurance policy.

|

Life insurance policy 5 | |||

|

Years |

Premium payment |

Total cash value6 |

Total death benefit6 |

|

1 |

$75,000 |

$56,735 |

$1,189,241 |

|

10 |

$75,000 |

$781,390 |

$2,967,375 |

|

20 |

$75,000 |

$1,940,406 |

$4,093,338 |

|

35 |

$75,000 |

$4,868,360 |

$6,539,648 |

We see strong tax deferred values and a large lift in estate benefits from year one, but let’s examine the big picture at age 85/year 35.

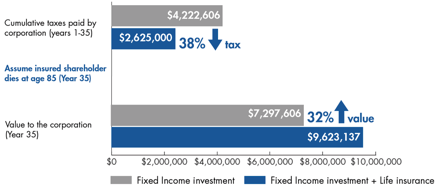

Levelling the tax in this scenario results in transferring away 38% less and helps in recapturing that wealth back into the business or family and correlates with a lift of 32% more on death. Along the way the CSV is on our balance sheet and provides liquidity and use and control for the business in times of opportunity or crisis.

This is compelling enough, but let’s look at the additional efficiencies that we gain in getting the values out of the company and into the family’s hands. This is where the tax benefits that are given to life insurance really shine over traditional fixed income investments due to the credits that life insurance proceeds create in the company’s capital dividend account.

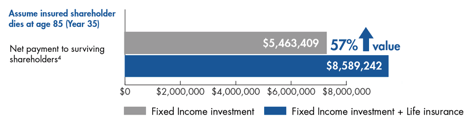

The family ends up ahead 57% by levelizing the tax! They transfer away less in taxes and keep more of their hard-earned wealth for the risks that they take.

What are Some Differentiating Features of Equitable Life’s Whole Life Product?

Equitable Life is one of the last of the mutual life insurance carriers left in Canada and it is the only mutual offering traditional participating whole life insurance or PAR whole life. Mutual means that it works for the benefit of its clients.

Most of the carriers in Canada used to be mutual but they demutualized and became shareholder companies, so they have to work not only to benefit the clients buying the policy, but ultimately to answer to the shareholders/investors that want a consistent yield on their investment. If this sounds like a similar yet different proposition, it is; but most carriers have been doing a fabulous job for Canadians in helping them build wealth, save on taxes, and transfer more wealth efficiently to their families.

In 2020 Equitable Life turned 100. It is a very seasoned and solid company that Canadians can count on. It typically has one of the highest LICAT ratios (Life Insurance Capital Adequacy Test) or capital adequacy reserves in the industry, so it is old, profitable, and asset backed, which are three amazing things combined together.

As a mutual company, it is owned by its customers, and if you’re buying a PAR whole life policy, you’re a part owner of the participating fund. Although our company’s par fund is not the largest in the industry, it does provide a nimbleness to manoeuvre in and out of the market in a somewhat silent or unseen manner. The company is small enough to be nimble but large enough to be on the institutional desks and participate in the bond and private placement opportunities alongside big players.

When you combine that with the exceptional fund managers and yields that they’ve been able to achieve year after year, you start to get a feel for what is backing the illustrations and company’s commitment to being great long-term stewards of people’s money. To round out its offering, Equitable Life also offers great options in term insurance, universal life, critical illness insurance, annuities and segregate funds, and it has a strong team of management, regional sales managers, advanced case consultants, and tax and estate resources.

We hope that you find this detailed article helpful. If you have any unanswered questions, our experienced insurance professionals will be happy to help you with any whole life insurance inquiries and quotes.

Brent Swatuk is a Vice President with The Gryphin Advantage Inc. He has been in the Insurance, Investment and Estate Planning Field for 20+ years. He started his career with London Life as an advisor, he has held various management/consulting roles in the employee benefits field as well as the Health and Welfare Trust field. He joined Equitable Life as a Regional Sales Manager in the fall 2017 helping some of the greater Toronto areas top MGA’s and their brokers. In January 2019 he transitioned to helping MGA’s and brokers in Eastern Canada on large and complex business succession and estate planning cases.

Owner of Budovitch Legacy Planners Inc. a boutique advisory that helped thousands of professionals and business owners by constructing the onramp to retirement based on proven financial models, experience and knowledge. We create specialized strategies that can increase wealth and retirement income, minimize taxes, provide tax efficient generational wealth transfer and ensure that your estate and family are protected.