When people think about investing, they usually focus on stocks, bonds, and real estate. But certain types of insurance — especially life insurance — can play meaningful and sometimes overlooked roles in a well-structured financial plan.

This article explains those roles in straightforward, non-technical language, including how life insurance can play various investment roles:

Although life insurance is primarily known for protection, some forms — particularly permanent life insurance — behave much like an asset class with stable, predictable outcomes; therefore, life insurance can also be sometimes viewed as an investment.

Because these policies often include guaranteed cash value growth and stable death benefits, they can be compared to fixed-income assets such as GICs or bonds, especially for individuals seeking certainty and low volatility rather than high market returns.

Unlike market-driven investments, life insurance benefits are generally unaffected by short-term market downturns, making them a useful stability anchor when combined with stocks and other higher-risk assets.

The most basic role of life insurance is to provide a tax-efficient payout at death.

This protective feature ensures your loved ones receive financial support even if markets are down when the benefit is needed most.

Certain permanent life insurance products (such as whole life insurance or universal life insurance) can function similarly to long-term fixed income:

When viewed this way, permanent life insurance can sit alongside:

The difference is that life insurance provides a guaranteed death benefit, not just a maturity value.

Insurance returns are not tied directly to financial markets, which means they can act as a diversifier within your broader portfolio.

When stocks or bonds are volatile, the guaranteed components of life insurance provide a non-correlated source of value, helping to smooth overall portfolio performance over time.

Insurance can improve after-tax outcomes through:

Better after-tax returns mean more of your investment income stays working for you rather than being eroded by taxes. Here is a detailed article about life insurance and taxes.

While all nominal financial assets are affected by inflation, life insurance can offer inflation-responsive features that help maintain purchasing power over time.

Here are three ways insurance can help in an inflationary environment:

This doesn’t mean life insurance outperforms inflation like some real assets (e.g., real estate), but it adds flexibility and resilience when inflation rises. Here is a detailed article on how Life Insurance Can Protect You from Inflation.

One unique advantage of permanent life insurance is the ability to borrow against your cash value, often at competitive rates.

This can enable a strategy sometimes called infinite banking — essentially using your insurance policy like a personal financing system:

This isn’t a quick path to wealth, and it works best as a long-term strategy where premiums have built significant cash value. But for disciplined investors, it offers a way to recapture interest that would otherwise be paid to banks.

Here is a detailed article on how Life Insurance and Infinite Banking.

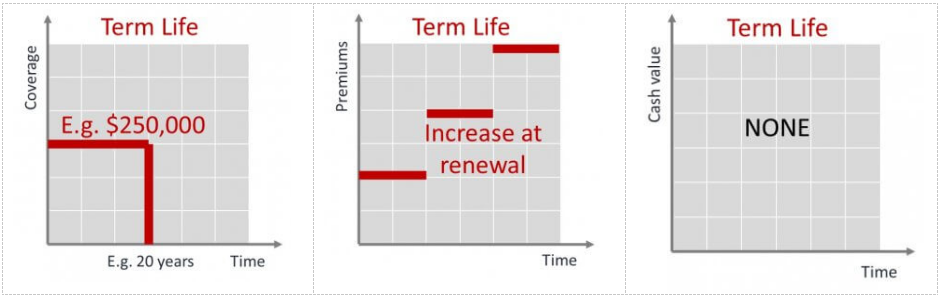

Not all life insurance works the same way. Each product serves a different purpose.

Primary role: Risk protection

In a portfolio, term insurance acts as pure protection, not an investment.

Here is a detailed summary on Term Life Insurance and its quotes.

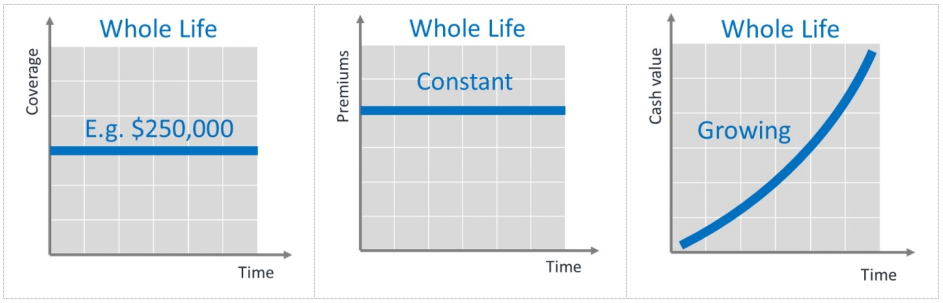

Primary role: Stability, guarantees, long-term wealth transfer

This life insurance investment type is closest to a conservative, fixed-income-style asset with built-in protection.

Here is a detailed summary on Whole Life Insurance and its quotes.

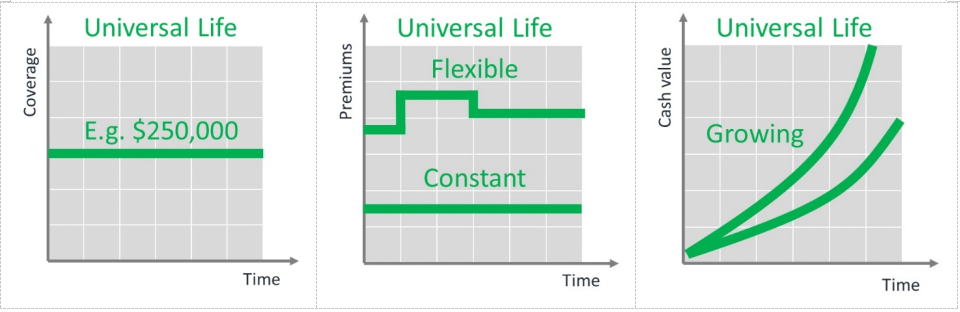

Primary role: Flexibility and tax-advantaged growth

This product sits somewhere between insurance and investing, and requires more active management.

Here is a detailed summary on Universal Life Insurance and its quotes.

Insurance is not only about death benefits. Some policies include living benefits that can play an important role in financial planning.

In portfolio terms, this acts as liquidity insurance, providing cash when medical or lifestyle disruptions occur. Here is a detailed summary on Critical Illness Insurance and its Quotes.

This is often the most important insurance asset for working professionals, as it protects the engine that funds the entire portfolio. Here is a detailed summary on Disability Insurance and its Quotes.

Insurance should not replace traditional investments — but it can strengthen the overall portfolio by:

For most Canadians, life insurance and living benefits play an important role in a well-rounded financial portfolio, helping protect your family’s financial security and provide peace of mind. Navigating these options can be complex, which is why our advisors are here to guide you through the decisions, leveraging their access to multiple providers to identify solutions that meet your needs while helping reduce costs.

To start, simply complete a life insurance quote for an initial, no-obligation discussion and let us help you explore the best opportunities for protection and savings.