When buying life insurance in Canada, avoiding the following five mistakes can save you and your family thousands of dollars.

When buying life insurance in Canada, avoiding the following five mistakes can save you and your family thousands of dollars.

We compiled for you an overview of five major mistakes to avoid when getting a life insurance policy in Canada.

Buying life insurance direct seems like it would be very good value, but companies such as Canadian Tire, HSBC, and some other insurance carriers generally offer higher-priced insurance solutions via their direct channels. There are several reasons for this, the first being that they often ask fewer health questions, so healthy individuals pay higher premiums. Direct policies do not offer preferred rates, and preferred rates are available to applicants in very good health and with good family health history. The savings can be significant. How significant? Standard rates for a 45-year-old male non-smoker applying for $750,000 of term 20 coverage would be $130.95 a month. The same person qualifying for preferred rates would pay $90.70 a month. That’s savings of $40.25 a month, or $9,660 over 20 years.

Here are examples of life insurance rates (as of September 2018) for our customers with a quote completed across 20+ insurers.

| Term 10, coverage of $250,000 | Term 20, coverage of $250,000 | Whole Life, coverage of $250,000 | |

| Male, 35 years old, non-smoker | $14.72 per month (31 quotes) |

$22.28 per month (31 quotes) |

$169.65

per month (14 quotes) |

| Female, 35 years old, non-smoker | $12.02

per month (29 quotes) |

$17.24

per month (31 quotes) |

$149.40

per month (14 quotes) |

Click here to get a life Insurance quote or

complete a form on the right

A conversion privilege allows the insured to convert their coverage without evidence of insurability. An example of this is someone who takes out a 20-year term policy, and, during the 20 years, has a heart attack or becomes diabetic. To take out new coverage would likely cost the insured considerably more, or more coverage may not be available. With a conversion privilege, you can convert your term coverage into a permanent plan without evidence of insurability at the best possible classification. When buying life insurance, you should also look at what type of permanent policies your plan is convertible to. Industrial Alliance, as an example, has a very broad range of permanent policies. Non-convertible term policies are more common among the no-medical hard-to-insure simplified issue market. Canada Protection Plan and Industrial Alliance both have non-convertible simplified issue term policies.

All life insurance policies in Canada have a two-year incontestability period, which means the insurance company can contest a claim if material information is not disclosed in the application. A large Canadian insurer noted that between 2007 and 2010, for every 1,000 claims, they paid out on 998. That’s not bad, but it still means two claims out of every 1,000 are not paid. Claims that are not paid are the result of the suicide provision or some other type of stated exclusion, or the insured put false information on their application.

LSM Insurance Tip: When buying life insurance, be truthful and review your application thoroughly before signing.

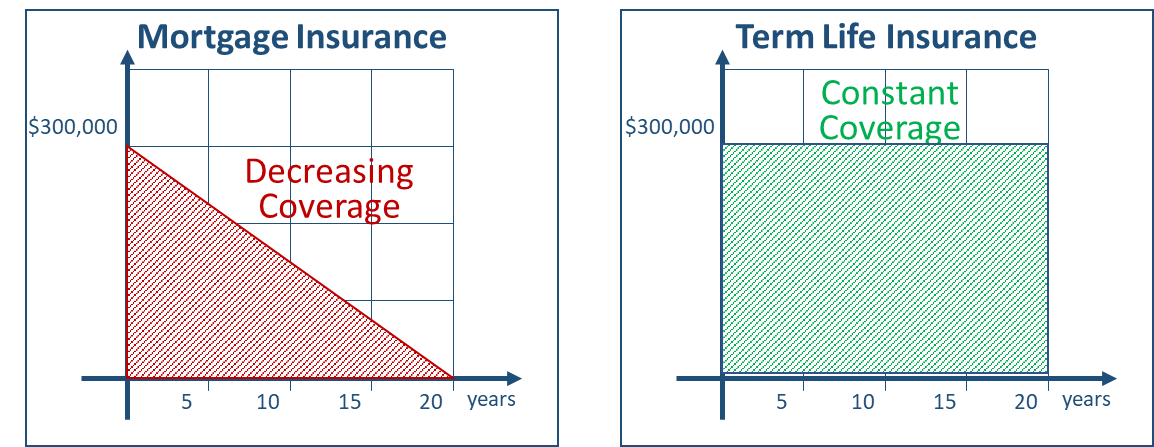

Creditor life insurance declines as your debt declines. The coverage is not portable, and generally, premiums are much higher than those of equivalent life insurance policies. Creditor insurance can be a good deal for smokers, as many of these plans use blended smoker and non-smoker rates, which offers good value to smokers and a bad deal to non-smokers. You should also note that many creditor life policies are issued immediately because many do the underwriting at the time of claim. This is a benefit to the lending institution because it avoids all the costs of underwriting a policy at the time of issue and only does it when and if there is a claim. The problem with this is that those applications that would have been declined are not uncovered until after the fact and the claim is denied. CBC Marketplace published a detailed analysis of mortgage insurance and the pitfalls consumers face. You can see it here.

Term Life Insurance is a great alternative to creditor life insurance that offers typically much better coverage for less.

Here is a visual overview how mortgage insurance (a type of creditor insurance) compares to Term Life insurance.

Captive advisors are those that only offer products from one company. Examples of this would be Primerica, the Cooperators, or State Farm (now part of Desjardins Life Insurance). Many of these advisors also have to meet certain sales quotas and may not offer some types of policies. Many of these captive companies do work out arrangements with other carriers for products they may not have in their line-up, so this does offer some extra options for their salespeople. Independent insurance brokers can provide solutions from a variety of carriers, providing the consumer with the best possible value. Ask your broker how many carriers they represent, how long they have been in business, about any certifications or designations they have, and for testimonials from past clients. Many brokers prefer working with specific companies, so try and find this out in advance and if that preference will work in your favor.

For more details on buying life insurance in Canada, visit our Term Insurance Instant Quote Page.

I’m looking around for a good life insurance. I used to smoke, but have quit for 6 years now. I’m just not sure how I would be able to know if an advisor is offering me the best possible policy or not.

Thanks – good question. Thomas this depends in part on your date of birth, smoking status, how much life insurance you want and the type of plan.

We work with multiple companies so we’ll make we match you up with the best plan for your needs. I will send you a separate email now.

Thanks Terry. Term 100 policies generally do not have a cash value some companies do have plans with a built in guaranteed cash value. Universal Life plans can have a level or increasing cost of insurance and an optional savings component. If you want a simple straightforward plan with no cash value a Term 100 plan would be a better option.

What is the difference between Universal Life Life and Term 100. I wanted something simple – not that inetrseted in a savings

Hello There,

Good info. I can’t afford my policy how do I get info on how much cash in the policy I simply can not afford it anymore. Can I negotiate any prepaenalty

The for the note. You can find out if your life insurance policy has a cash value, what it is, if there is a taxable gain and if there are any surrender penalties by contacting the insurance company. As a rule of thumb any surrender charges which go against the cash value in the policy are not negotiable. What is is the policy will govern what your receive.

If I’m buying a life insurance policy do I have to name a beneficiary, I’m single now.

Hi Reggie, Thanks for the note. You could also name the beneficiary as “estate” and it would be split according to your will. You could also name the beneficiary and change it down the road.

How often do brokers quote a more expensive rate just to get a bigger pay? Do brokers always look to get the best for the client or whats best for them?

There are always a few bad apples. But most brokers do a good job for clients. Having said that its in your best interest to do a check on the broker you are working with, ask how long they have been in thge industry you can also ask for references from existing clients.

How do I know the surrender penalty if I cancel my Universal policy the statements says accumulation fund is ….

Hi Igal,

The statement may not say what the surrender penalty is. You should contact the insurer to verify this and if there are any tax implications.

Can you send me an application I recently moved to the Philipines but I’m a Canadian citizen. I’m looking for $200,000 Term 20 coverage. How much would it be I’m born …. and don’t smoke

Thanks for the note Eduardo. But you would have to be in Canada when you complete your application and the broker would have to be licensed in that province.

What can I expect in term of medical ttests when I apply for life insurance. I hate Needles. I’m 42 and want $300,000 but will take less.

Hi Mike, The medical tests verify from company to company. The higher the face amount and the older the insured the more likely the medical tests,

Assumption Life’s Flex Term policies offer no medical tests 18 to 65 amounts up to $250,000 of coverage.

I am interested in Preferred Rates. I am 34 year old very healthy and fit female. I have one child who is 7 and I would like to provide for her until she is 30 and out of school. Which company has the best rates?

Thanks Kelly. If you are looking for a 23 year term (30-7) Industrial Alliances Pick a Term you can pick term 10 to 40 years could be a good fit. They also have preferred rates on this plan for applicants in excellent health with very good family health history.

Hi Paolo,

Thanks for the note. There should be a fee to cancel your life insurance. Certain Universal Life policies have surrender penalties, these are charges against cash within your policy and not a fee you pay out of pocket. In a way it equates to the same thing.

Can the bank charge mne a fee to cancel my life insurance.

How do I go about converting my Term policy. I’ve lost touch with broker, can I go to the insurance company direct or is it better toi work with a new broker. Any differenc in premium. TY

Most companies prefer you use a broker and you also have the advantage of the brokers advice and on going assistance with service related issues.

Hi Eddie,

Guaranteed Renewable and Convertible (R&C) Term life insurance allows you to convert your term policy to any permanent policy offered by your insurance company during the life of your term. The new rates would be based on your attained age and you would need to complete a short application to exercise the conversion. A main benefit of a conversion is that you are not required to provide any evidence of insurability in the application.

However since the conversion rates are based on your new, attained age its a good idea to have a broker look at quotes for other permanent plans available in the market. It never hurts to give yourself time before your term policy renews to apply for and try to obtain good rates for competitive Whole Life, Universal Life and Term to 100 plans.

A good broker who represents most major life insurance companies can help you get all this done. Feel free to fill a quote request at the link below and you and we will also have a broker follow up with you to discuss your options.

https://lsminsurance.ca/canadian/universal-life

Thanks,

Syed

Hi Oscar

In Canada we are very fortunate to have fully guaranteed insurance products. In many countries insurance is completely adjustable which means the companies can change the premium/face amount or both at any time. The more guaranteed a policy is, the more risky the plan is to the insurer and the more expensive it is too offer. There are fewer and fewer fully guaranteed policies available today.

Hello Usain

I am sorry that you were declined for mortgage insurance. Creditor insurance offered through the lender is underwritten differently than regular life insurance. With creditor insurance there are cetain ‘knock out’ questions one of which is diabetes. When you answer ‘yes’ you are not elgible for thier insurance. It does not mean that you won’t be approved for regular life insurance. Life insurance which is underwritten will still consider you if the diabetes is under control and you don’t have any other complications which would make you uninsurable. It would be worthwhile to talk to your advisor.

Your argument on buying from a captive agent does not wash. Who are joking most brokers only work with one or two insurance companies only and the ones who pay the most commission.

Thanks Robyn. But I don’t share your contention that most brokers work with only one or two companies and only work with the ones who pay a commission. I agree there always a few bad apples, but most brokers are committed to helping clients. Having said that consumers should research the broker and agency they are working with.

Does Primerica have preferred rates . I have high blood pressure but no other issues

Hi Justin,

Thanks for the note. Primerica’s policy are sold via their in house captive sales house and are not sold through brokers. They do offer preferred rates as do most Term life providers. But preferred may be a challenge if you are taking medications for high blood pressure.

My sister wants to switch from … to … because her friend starting working there. I think she is making a big mistake, I sold her the policy when I was working as a broker but I’m out oif the business now, not much of a salesperson how can I convince her to keep what sho has.

Make sure the other broker has your sister complete a replacement form which clearly compares the two policies and highlights the advantages and disadvantages.

She should know that if she is replacing a Permanent policy, that Permanent life insurance rates in Canada have gone up substantially in recent years and her plan could be locked in at very fvourable rates.

I’m Pipe smoker and want to make sure that I can qualify for non-smoker rates on my life insurance I only smoke my pipe once a week know there’s a big price difference and I don’t want to be overpaying

Hi Jordan,

Thanks for the note. Most insurance companies will classify you as a smoker. Some have large cigar and pipe smoking rates which are lower than smoker rates.

We will send you a separate email to you now so we can get more details and look into which options are best.

I was declined for mortgage insurance last year at ….

Do I have to mention this on my application and do you think I can get life insurance I think it was related to my diabities which is really not that bad

Hello Usain,

It depends how the question appears on the application. If it asked if you have ever been declined for life insurance you would have to put “yes”. Most traditional life insurance applications do have a diabetes related question. If your diabetes is under control there s a good chance you will qualify. Simplified Issue life insurance – no medical tests and a short series of health questions may also be a good solution.

Am I overpaying. I have 300,000 whole life and I’m paying 200 a month my broker says the rates have actually gone up. Is She just trying to get me to keep the policy

Thanks for the note Oscar. It is true Whole Life rates have increased among most carriers and some companies have stopped offering their WL plans all together.

I smoke 2-3 cigars a months, will I be treated as a smoker.

If so how long must I stop for for it to noyt show up in the test.

Hi George, See the attached article https://lsminsurance.ca/tips/non-medical-life-insurance. Canada Life appears to be the most favourable permitting 1 Large Cigar per week with a negative Cotinine test. The results may not show up in a saliva sample if you are tobacco free for a few days but you are still required to answer all questions truthfully otherwise you run the risk of the policy becoming null and void.

I think the biggest mistake people make when buying life insurance is not reading over the application.

One of my best friends family is dealing with the repercussions of that right now.

Hi Sheldon, Sorry to hear about your friend. You make an excellent point. Thanks for sharing.

Hi Raenora,

Just as a side note, when applying for individual life insurance you only need to disclose your existing individual life insurance policies, not your group employer plans.

Hopefully that helps out.

Thanks

Thanks Raenora. Yes you can have more than one life insurance policy. In fact many people have life insurance with multiple carriers. You should disclose outside policies on your application if it asked about existing coverage in place.

Most insurance companies will insure an applicant for up to 20 times their annual income. This is a rule of thumb and other variables diue come into play.

I want to purchase life insurance in addition to existing employee coverage to ensure my child’s financial security should something happened to me. Can I even have more than one life insurance policy and would that effect rates or eligibility at all?

37 year old single mother in good health/no smoking; one child 7 yrs. Thanks in advance for responding!

Hi Yolanda,

Thanks for the note. We will be in touch by email shortly. Depending on the type of cancer and if you are still receiving coverage no traditional life insurance may not be available or available on a rated basis – meaning an extra premium is charged due to what the insurance company views as an extra risk. Simplified Issue Life Insurance – no medical tests and a short series of health questions should be available. But these plans have lower face amounts and higher premiums than most traditional plans.

Your existing policy may have a conversion feature that allows you to convert the coverage without a medical to a Permanent plan and or the renewal may be less expensive than a new Term policy if the plan has a rating.

I have a Term policy coming due for renewal shortly.

I am 55 and was diagnosed with breast cancer 4 years ago, but have no problems since.

Can you give me a quotes on $280,000 for me and $350,000 for my busband, he is 49.