What are buy/sell agreements?

What are buy/sell agreements?In a way, a business partnership can be compared to a marriage. It may help to think of a buy/sell agreement as a sort of “prenup” between business partners. The buy/sell agreement is a contingency plan that outlines the conditions under which a partner’s interest in the business will be bought out by the other partner(s), or the business itself.

The most common event covered by a buy/sell agreement is the death of a partner, outlining the actions that are taken and method of funding used, such as the proceeds of a life insurance policy, to buy out the deceased partner’s business interest. As well, a well-drafted agreement will include other provisions like a shotgun clause triggered in situations where a business partnership has severely deteriorated, a right of first refusal to the other partner(s) before selling to an outsider, the retirement or exiting of a partner, the disability of a partner or other specific circumstances like serious misconduct, incarceration, or divorce, and establishes the rules for an orderly wind-up or restructure.

If a partner dies, the beneficiaries of the deceased may not want to become actively involved in the business and the surviving partner(s) likely do not want the beneficiaries to be involved in the business either. However, the deceased’s heirs are entitled to the fair market value equivalent of the deceased’s interest in the business.

The benefit of a buy/sell agreement is that it allows for a smooth transfer of the business interest, avoiding potential disputes over the value of the business, providing a clear dollar value and price, a payment schedule, the calculation formula or method used (arbitrated by a pre-determined third party if necessary), the source of funds and clear definition of the manner in which the purchase will be financed to purchase the deceased shareholder’s interest and other terms of sale.

Where financial contracts such as life insurance are to be utilized, the requirement to purchase these contracts and a reference to contract numbers or similar information should be included in the agreement. Most importantly, with a legally defined, contractual, exit strategy in place, it avoids conflicts and litigation in the future, which could jeopardize the financial well-being of the departing shareholder and/or their family and even the financial health and viability of the business itself. By having a legal agreement in place, the likelihood of a confrontation between the departing and remaining shareholders or their spouses or families will be minimized. Where appropriate funds have been set aside in the agreement, it creates a degree of liquid cash for what would normally be illiquid shares of a private corporation. Consequently, employees, customers, suppliers, and creditors will be reassured about the continuity and financial health of the business and the remaining shareholders after the buyout.

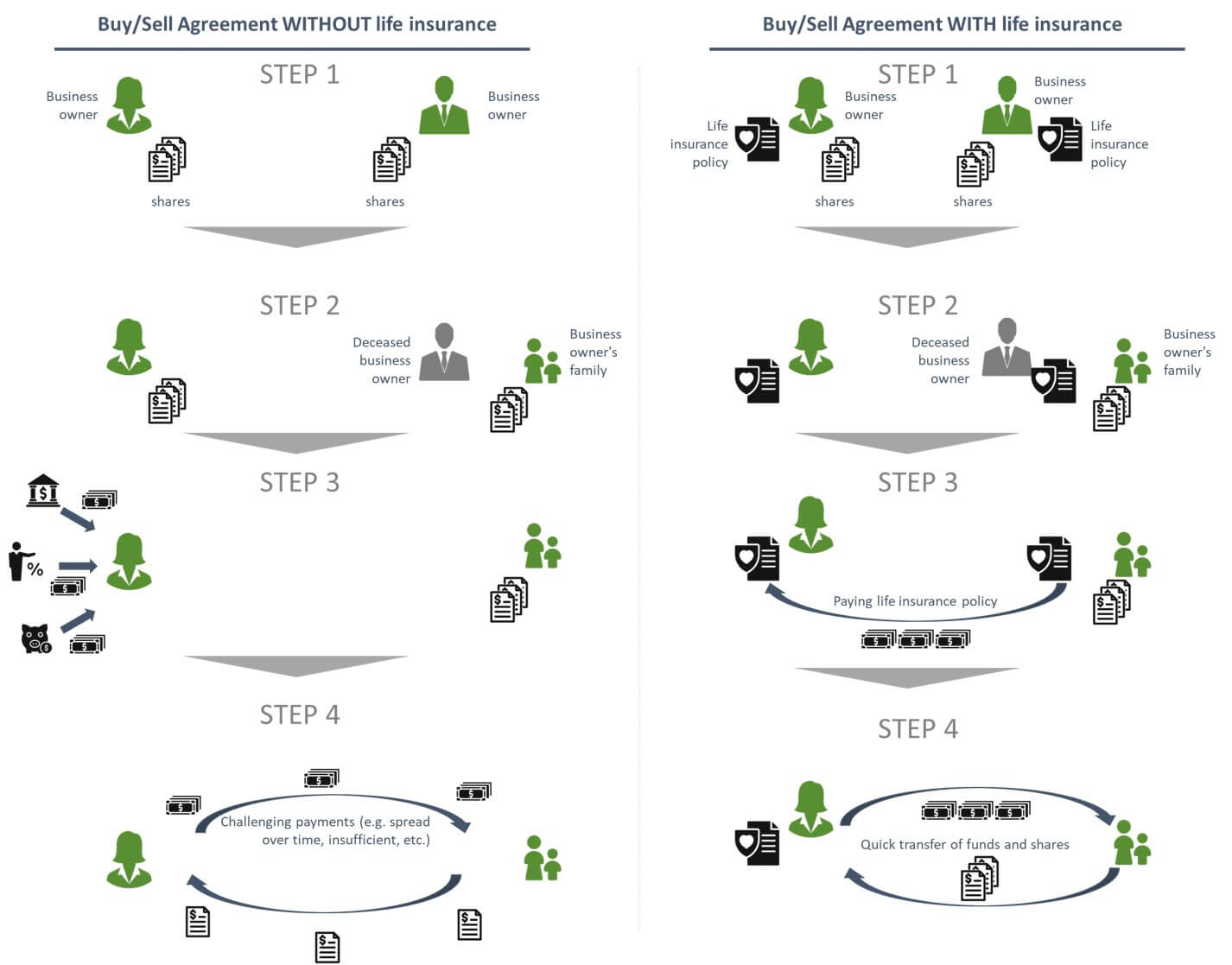

An overview below shows how a buy/sell process works without life insurance and with a life insurance policy:

When the buy/sell agreement is funded through life insurance, upon the execution of the legal agreement, each partner has a life insurance policy equal to the value of their ownership interest taken out. Utilizing a life insurance contract to fund the buyout has multiple benefits. First and foremost, for the family of the deceased owner, it provides immediate liquidity for the buyout when it’s needed and assures a prompt payment, with a guaranteed fair and definite price and a guaranteed buyer for their interest. It also ensures that they, or an executor, do not have to step in and become involved to protect their interest and frees the deceased owner’s family from the risk of future business losses.

For the surviving partner(s), it avoids the problem and costs of borrowing money and enables the business operations to continue without costly interruptions, strengthening its credit position and guaranteeing the continuity of management, ensuring the ownership and control of the business stays in the hands of the surviving owner(s). The funds used to buy the deceased’s share are effectively the insurance premiums, purchased for pennies on the dollar, and may be lower than any other alternative.

Some of the pitfalls include matching the life insurance product to the buyout need and timing considerations.

Two major mistakes when choosing an insurance solution for a buy/sell agreement are:

There are numerous complex structural, income tax, ownership, beneficiary and even family law considerations, when setting up a life insurance policy to fund the buyout.

Proper planning and advice are required to optimize the outcomes for all parties involved. At a basic level, there are two methods that buy/sell arrangements at death can be structured. Either the surviving shareholders can purchase the deceased’s shares, or the corporation can purchase the deceased’s shares by redeeming the shares. If the agreement provides that the surviving shareholders will purchase the deceased’s shares, then the buy/sell obligation may be funded with insurance owned by the shareholders using the “criss-cross purchase” method, or it may be funded with insurance owned by the corporation using the “corporate redemption” method.

Within these methods are structures that take into consideration equitable funding of premiums between partners; tax consequences to the deceased shareholder, their heirs, their estate, and to the surviving shareholder(s); the use of capital dividend account balances; the adjusted cost basis of the policy; the use of holding companies; stop-loss rules; potential grandfathering of tax legislation; creditor protection; GRIP (general rate income pool) balances; legal considerations; and overall complexity.

As with many things when it comes to business, a buy/sell agreement is not something a single advisor should consult on and it should ideally be a collaborative approach. It is recommended you have your corporate lawyer draft the agreement, your accountant review the tax ramifications of how the agreement works, and a financial advisor or life insurance agent properly review the funding.

Many businesses are worth far more than what they have in the bank, and even if they have enough money in the bank, it usually does not make sense to drain all their money on a buyout. So how could a buyout be funded?

Unbiased, professional advice is particularly important when sourcing a life insurance policy for a buy/sell agreement. Business owners and entrepreneurs are generally very busy people without a lot of time to rate shop and meet with multiple agents.

One primary difference between a captive agent vs an independent broker is the number of insurance carriers they represent. Captive agents are typically paid by a single insurance carrier and can generally only sell its policies, while independent brokers work for themselves and offer a much broader product selection representing multiple carriers, which usually means their clients can find either the lowest price or the best value.

For business owners who work in higher risk industries or have pre-existing health concerns, independents have access to a wider variety of policy options, so they can often find appropriate coverage for unique risks. Ultimately, the key is to do your homework, research your options, and work with an advisor you trust to help you make an informed decision.

If you are interested in finding out more about life insurance and how it can help you, our experienced insurance brokers can offer necessary guidance and help you with life insurance quotes across 20+ insurance companies.

Eric Benchetrit is a financial services industry consultant and thought leader, considered by his peers as one of the most informed and knowledgeable authorities in his space, providing financial advisors, life insurance agents and related industry professionals expertise in complex tax and estate planning. Eric’s business approach uses a relentless commitment to professionalism and attention to detail, using a collaborative and integrated planning style that works in conjunction with a client’s entire advisory team. His communication style describes complex structures in easy-to-understand terms. He has been in the financial services industry for over a quarter century in a variety of roles, including marketing and distribution at the executive and wholesaling level for insurance companies and Canadian investment firms. He’s also been a faculty member for Seneca College’s Financial Services Practitioner certification program, whose graduates receive credits towards CFP (Certified Financial Planner) and CLU (Chartered Life Underwriter) designations. He’s been involved in many speaking engagements at industry events over the years and has also appeared on radio programs and call-in shows. He has written articles and has been quoted and profiled in several industry publications. He has co-chaired Canadian and international delegations, meeting Prime Ministers, parliamentarians, congressman and senators, and holds a Specialized Honours B.A. from York University. He is married with two children, lives in Thornhill, Ontario, and is a very active member of his community, being recently honoured for volunteering his time and sitting on the boards of multiple charitable and non-profit organizations.

Eric Benchetrit is a financial services industry consultant and thought leader, considered by his peers as one of the most informed and knowledgeable authorities in his space, providing financial advisors, life insurance agents and related industry professionals expertise in complex tax and estate planning. Eric’s business approach uses a relentless commitment to professionalism and attention to detail, using a collaborative and integrated planning style that works in conjunction with a client’s entire advisory team. His communication style describes complex structures in easy-to-understand terms. He has been in the financial services industry for over a quarter century in a variety of roles, including marketing and distribution at the executive and wholesaling level for insurance companies and Canadian investment firms. He’s also been a faculty member for Seneca College’s Financial Services Practitioner certification program, whose graduates receive credits towards CFP (Certified Financial Planner) and CLU (Chartered Life Underwriter) designations. He’s been involved in many speaking engagements at industry events over the years and has also appeared on radio programs and call-in shows. He has written articles and has been quoted and profiled in several industry publications. He has co-chaired Canadian and international delegations, meeting Prime Ministers, parliamentarians, congressman and senators, and holds a Specialized Honours B.A. from York University. He is married with two children, lives in Thornhill, Ontario, and is a very active member of his community, being recently honoured for volunteering his time and sitting on the boards of multiple charitable and non-profit organizations.