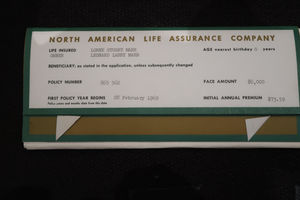

I was unknowingly introduced to the value of life insurance when I was about one month old. My father, Larry Marr, a Chartered Accountant at the time, purchased a life insurance policy on my behalf from North American Life.

Wisely (in my opinion), he had already purchased policies for my two older brothers.

My brothers – one a successful Lawyer and the other an equally successful Journalist – did develop some health challenges down the road and these Whole Life policies, which included an enhanced protection feature, formed the foundation of our insurance portfolios.

We were also rewarded when North American Life was purchased by Manulife. The amalgamation was effective on January 1, 1996, making Manulife the largest life insurer in Canada. A few years later, in 1999 demutualization was approved by policyholders, converting Manulife from a mutual life insurance company to an investor-owned, publicly-traded stock company. Shares in Manulife Financial Corporation begin trading later that year on the TSX, NYSE, SEHK, and PSE.

The transition didn’t go as smoothly as planned. U.S. investors rejected the proposed introductory price of $20 to $23 per share. Not allowing this minor hitch to deter their plans, Manulife jumped into the market at an even $18. My brothers and I each received shares that were more than double the value of the premiums we had put in and we still maintained all of the policy benefits. A pretty sweet deal!

Manulife’s president Domenic D’Alessandro wasn’t disappointed either, “Today’s price is not a bad price at all. If one looks at the price in relation to other indicators like book value or earnings, the price is very acceptable.”

Many Financial Experts have different opinions on Children’s Life Insurance.

Ed Rempel, a certified financial planner with Armstrong & Quaile Associates Inc says, “The dumbest idea is to buy whole life insurance for your child. I’ve seen this awkward situation many times. Clients in their twenties cashing in very low return policies that were inflicted on them when they should be building wealth. Parents have many more important uses for their money, such as life and disability insurance for themselves, their retirement goals, and their child’s RESP.”

Mr. Rempel makes a valid point, however, there are many benefits to insuring a child when he is young and healthy – mainly, you can lock in a policy at low premiums. Should the worst happen, the money will allow you the time you need to properly grieve your loss, without the financial burden of funeral costs, time off work, etc.

Other reasons for buying life insurance for your children include a funding vehicle for higher education, a tax shelter for individuals in a higher tax bracket or a tax-free way to transfer wealth to children or grandchildren. There are also many ways the child can use the policy later in life. A whole life insurance policy holds cash value, which can be a great asset when the child becomes financially independent.

According to Alan Moore, founder and certified financial planner at Serenity Financial Consulting, “Life insurance can also be used to pay off debts or be part of estate planning for ultra-high net worth clients.” He adds, “Notice that a newborn doesn’t fall into any of these categories. Outside of the extremely rare case of the child supporting the family by being a child star, you simply shouldn’t buy your child life insurance.”

Many people believe the advantages of whole life insurance outweigh the disadvantages, while others feel it is the other way around. Opinions on the matter vary greatly. Here are some facts to help you create an opinion of your own.