Whole and universal life insurance are permanent insurance policies. This means, as long as they are in force they don’t need to be renewed – they do not expire. Both also have a cash savings component to help you build and manage wealth.

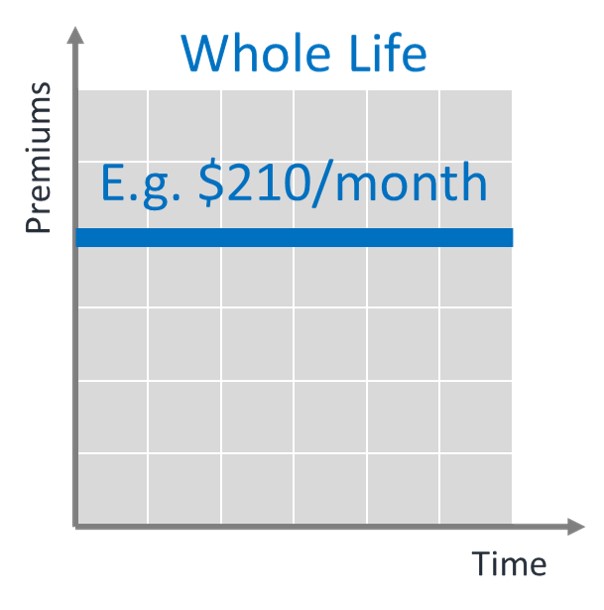

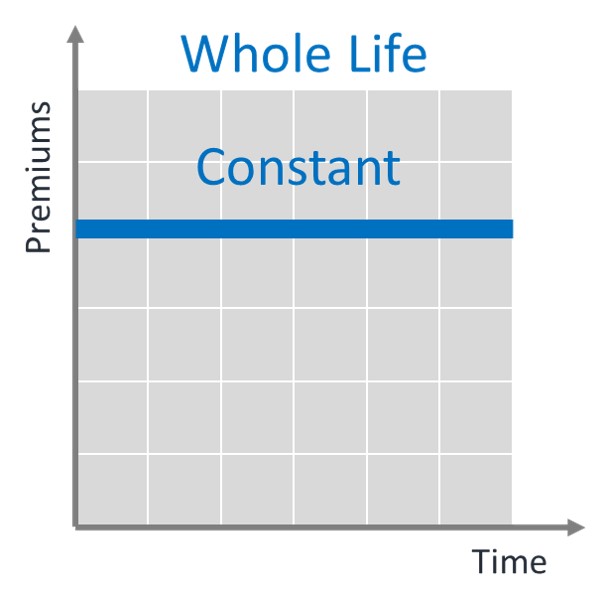

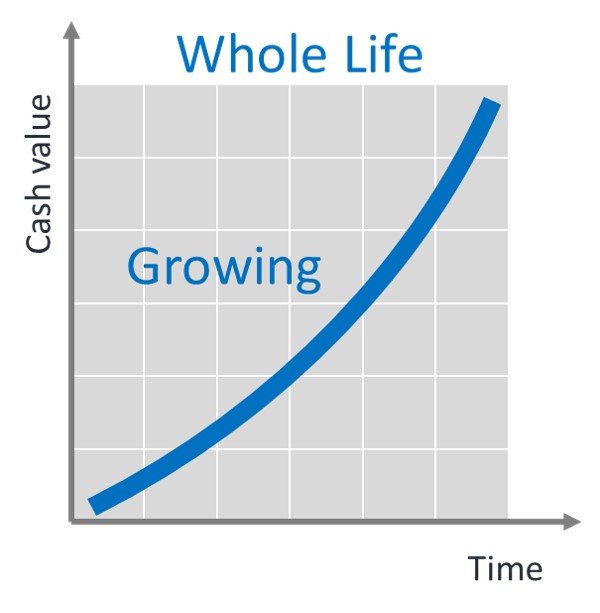

The main difference between whole and universal life are seen in the way the cash account is handled. You will provide a fixed premium that is shared between the cost of insurance and the cash savings account for whole life, and your investment in the cash account is guaranteed. To access your cash, you can surrender the policy or leverage it as a loan.

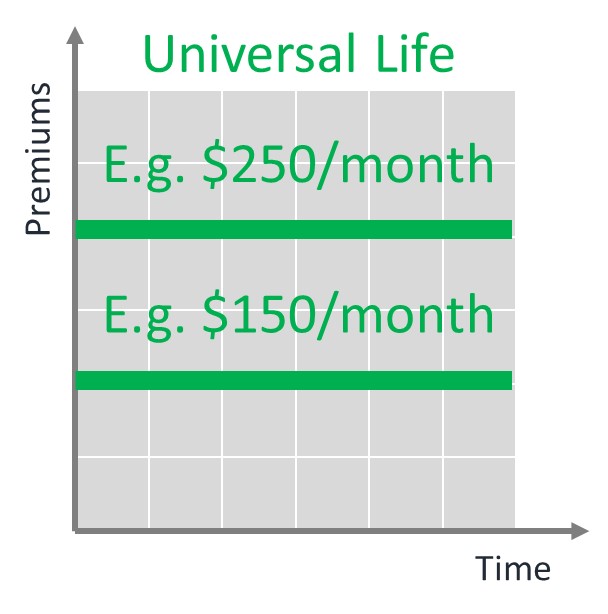

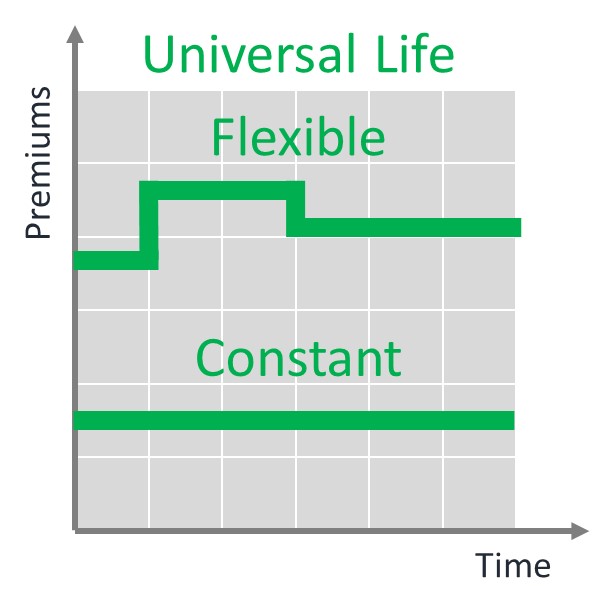

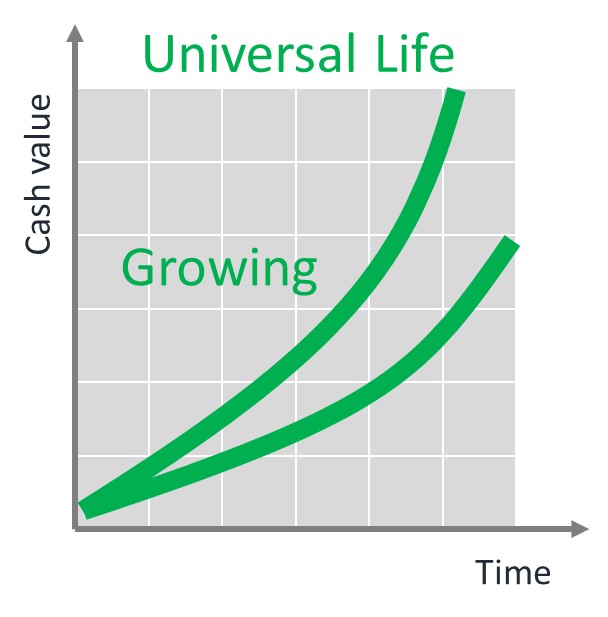

On the other hand, universal life insurance has no guarantees. Your investment is more at risk. Your premium is also not fixed. You have a minimum and maximum that you can contribute. The minimum only covers the cost of insurance. You must contribute more than the minimum and up to the maximum to fund your cash savings account. However, the cash account is far more flexible than with whole life insurance – you can withdraw the cash or use it to support the policy’s premium. Remember, however, that removing all your cash and letting the policy lapse leaves you without coverage.

Let’s dive into a deeper comparison.

| Whole Life Insurance | Universal Life Insurance |

| Whole life insurance fills two financial needs: lifelong coverage that does not expire and a tax advantaged savings account.

The savings account invests your cash, giving you an asset you can access by surrendering (terminating) the policy. Alternately you can use the cash as collateral for a loan. |

Universal life insurance also fills two financial needs in that you get lifelong coverage and a tax advantaged savings account. The main differences from whole life are that the cash account is much more accessible, you are required to manage the policy hands-on, the investment is not guaranteed, and you have a range (min/max) instead of a fixed premium.

Typically, universal’s cost of insurance (minimum premium) is cheaper than whole life’s premium. |

This chart illustrates more main differences between the two products.

| Whole Life Insurance | Universal Life Insurance | |

| Coverage length |  |

|

| Premiums comparison |  |

|

| Premiums at renewal |  |

|

| Cash accumulation |  |

|

To make the ideal choice between whole and universal life insurance, you must be aware of several things. We’ve detailed these points in the chart below. Pay special attention to the investment management portion. One requires you to have a more active role in the investment management.

| Whole Life Insurance | Universal Life Insurance | |

| Coverage length | Life long | Life long |

| Insurance coverage | Yes | Yes |

| Cash accumulation i.e. policy has a cash value | Yes | Yes |

| Can choose amounts going into insurance and cash accumulation | Yes | Yes |

| Eligibility for dividends | Yes | No |

| Investment management | Investments are managed on behalf of a policyholder, no need to get involved | Investments can be managed by policyholder, requires understanding of markets |

| Premiums | Typically, flat premiums (also called level premiums) | Flexible premiums |

| Tax advantage | Yes. Your investment grows tax free as long as you do not contravene the maximum tax accrual rules (MTAR) limit. If you do, your investment will attract tax. Cash value withdrawals are not always tax free. Speak with your advisor if you wish to access the cash. | Yes. Your investment grows tax free as long as you do not contravene the maximum tax accrual rules (MTAR) limit. If you do, your investment will attract tax. Cash value withdrawals are not always tax free. Speak with your advisor if you wish to access the cash. The cash withdrawal can affect how much is given to your beneficiaries. |

As with every insurance policy, there are pros and cons to consider. Let’s start with the pros.

| Whole Life Insurance | Universal Life Insurance |

| No investment experience required. The investment portion is managed on your behalf. | Investment flexibility. For those that like to be more actively involved in the investment process, universal life allows you to manage the cash account. |

| Fixed premium. You know what you are putting in each month. | Premium contribution flexibility. Ideal for those with freelance or commission income, flexible contributions allow you to match your input to the month’s budget needs. |

| Wealth management. Whole life helps high income earners manage their wealth and their life insurance in a very convenient way. | Potentially lower premiums. Since you can choose the amounts you contribute, universal life often costs less than whole life. |

Both policies have their advantages, but there are some drawbacks to consider.

| Whole Life Insurance | Universal Life Insurance |

| Investment preference. You do not have control over the investment portion, therefore are limited in the management of it. This could be an issue if there are particular things in which you wish to invest. | Investment experience is required. Having more control over the investment portion is great – unless you have no investment experience. Then you could be missing out on gains. |

| Cost. Because of the guarantees, whole life insurance is one of the most expensive products on the market. | Potential exposure to stock market. The investment is not guaranteed and can dip based on stock market performance. |

| Long range plan. The investment grows slower than other options and to get the most out of it, you must leave it alone for a number of years. | Careful planning. It’s easy to tap into the savings account when you have an emergency (which is a pro at the time!) so if you were planning to let it grow to the support the policy, you may need to adjust your budget. |

One is not better than the other. Both speak to the individual investor’s risk tolerance and desire to be hands on or hands off. From a purely practical standpoint, universal life tends to be cheaper, but it comes with a higher risk and more hands-on involvement. If you are undecided about which policy is best, speak with a broker. They will help you identify your risk factors and risk tolerance, then match you with a policy – either whole life or universal – that is best suited for your needs.

| Go for Whole Life Insurance if you want | Go for Universal Life Insurance if you want |

| Coverage that doesn’t expire | Coverage that doesn’t expire |

| Premiums that never change | Flexible, adjustable premiums |

| Professionally handed policy and investment | Hands-on policy and investment management |

| Professionally monitored, decisions made on your behalf regarding the investment | You make the decisions about your investment and how to manage the policy |

“A wise industry mentor I worked with once described universal life policies to me like this: “The greatest advantage of UL over whole life is its flexibility; the greatest challenge for UL over whole life is its flexibility!”

We are blessed to have a wide variety of permanent life insurance options, across many carriers, competing for our business. This ensures that no matter what your goals are, and how you want the ride to look along the way, there is likely a vehicle to get you there.

If you want your insurance plan to be more rigid and predictable for dollars in, with more safeguards from the market to ensure the outcome, then whole life may be the better option for you.

If you have the tolerance and discipline to manage adjustable premium payments, along with uncertain returns that may capture more upside or downside of the markets, then universal life can perform well for you.

These are plans that are with you to the end of your life so take the time to consult a licensed independent advisor who is well-trained in understanding the differences between these products; in determining your needs; and in recognizing your risk tolerance to help you find your best fit solution.

When talking about the cost of whole life insurance vs universal life insurance, it is not necessarily an apples-to-apples comparison. Whole life has a fixed premium where universal life does not. Let’s take a look at some whole life numbers, then consider them against the flexible premium of universal life.

| $300,00 coverage for the following scenarios | Whole Life Insurance | Universal Life Insurance |

| 30 year-old male, non-smoker, no health pre-conditions | $155 / month | The premium is not fixed. You are allocated a minimum that supports the cost of insurance, and a maximum with the amount over the cost funding the savings account. Universal life insurance minimums are typically lower than whole life premiums. |

| 40 year-old female, smoker, no health pre-conditions | $213 / month | |

| 50 year-old male, non-smoker, no health preconditions | $390 / month | |

| 60 year-old female, smoker, no health pre-conditions | $565 / month |

“I frequently witness advisors managing policies ineffectively. In order to provide a death benefit that is both affordable and maximize return on premium, a Universal Life insurance policy must be constantly monitored and periodically adjusted. In addition to preventing nightmare scenarios where policies become so drastically underfunded that policyholders can no longer afford to get them back on track once they finally recognize a problem, changing the premium and fund options will keep the policy operating at peak efficiency.”

No matter what policy you choose, if you are a smoker you are looking at higher rates – sometimes even double the rate of a non-smoker. This is because smoking is a risk on every level. It impacts and shortens your health and it can start a fire in your home. If you smoke when you obtain the policy but quit and remain a non-smoker for a number of months, you can talk to your advisor to see if a reduced rate is possible.

Whole and universal life insurance is offered through major Canadian insurance companies like Sun Life, Manulife and Equitable Life. These policies have very specific requirements in order to remain tax compliant, and to properly assess your long-term needs. Always work with an experienced professional when setting up permanent insurance.

“Key difference between whole life and universal life is with whole life the life insurance company pay a dividend in the form of cash value which accumulates over time under the insurance policy, with universal life you can choose the investment direction of the cash value according to your investment profile. Whole life insurance typically costs more than Universal life however the cash value within a whole life policy will not fluctuate in value where as a universal life policy the cash value will fluctuate according to the markets and your investment direction.”

There is another option for those that want permanent insurance for a lower cost. Term 100 covers you to age 100 with pure insurance. This means there are no extras – you get a premium that does not expire but there is no cash savings account.