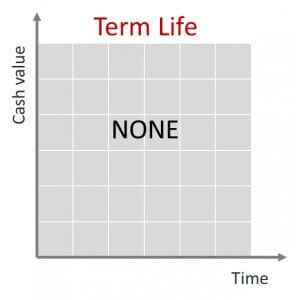

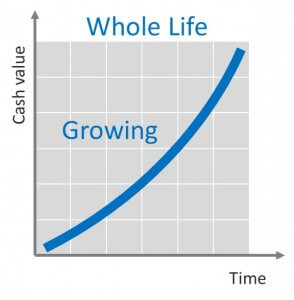

The main difference between whole life and term is that term expires and whole life does not. Additionally, term is “pure insurance,” meaning it only offers insurance and nothing else. Whole life, on the other hand, has an investment component to help you save money or build wealth.

Let’s take a closer look.

| Term Life Insurance | Whole Life Insurance |

| Term life insurance provides coverage for a set number of years. For example, Term 10 is 10 years, Term 20 is 20 years, etc. It’s a simple, straightforward product with no savings or cash accumulation components. If the policyholder dies, the beneficiaries receive the coverage amount. | Whole life insurance was created to solve two needs – lifelong insurance that did not expire and tax advantaged savings.

In the whole life cash savings component, your money is invested. You can access it by surrendering (terminating) the policy, or you can borrow against its value. |

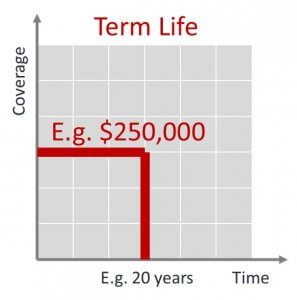

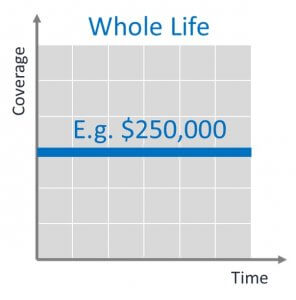

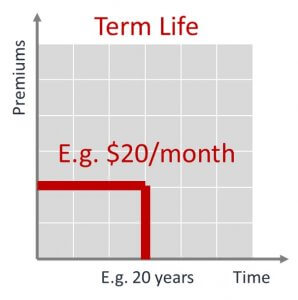

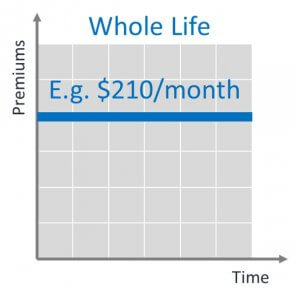

This chart illustrates more main differences between the two products.

| Term Life Insurance | Whole Life Insurance | |

| Coverage length |  |

|

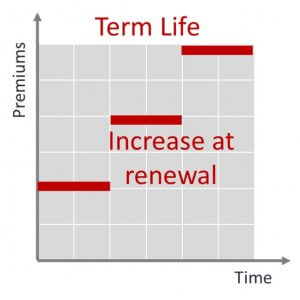

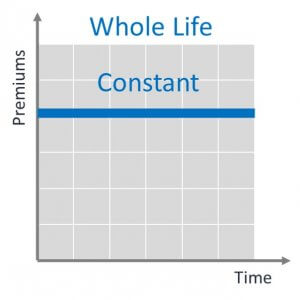

| Premiums comparison |  |

|

| Premiums at renewal |  |

|

| Cash accumulation |  |

|

When you are choosing between term life and whole life insurance, there are six things to keep in mind. We’ve outlined them in the chart below. The reason you want to consider these factors is this: your choice will determine if you need to renew the policy, if you can use the policy as a cash savings vehicle, and if the policy suits your risk tolerance.

| Term Life Insurance | Whole Life Insurance | |

| Coverage length | Limited | Life long |

| Insurance coverage | Yes | Yes |

| Cash accumulation | No | Yes |

| Can choose amounts going into insurance and cash accumulation |

No |

No |

| Eligibility for dividends | No | Yes |

| Risk | The risk is that the policy expires and costs more – significantly more as you age – each time you renew. | There are very little risks. The premium will not increase, and your investment is guaranteed. |

As with every insurance policy, there are pros and cons to consider. Let’s start with the pros.

| Term Life Insurance | Whole Life Insurance |

| Lower price: Term is the cheapest of all the policy types. | Life-long coverage: Once in force there is no need to renew. |

| Riders: Term can be customized with riders depending on what the insurer provides. Return of premium and critical illness are two examples. | Guarantees: Your investment is secure and your premiums will never increase. |

| Access: Since term is so affordable and also available as a simplified and guaranteed product, it is fast and easy to obtain. | Savings: The ability to save cash in a tax advantaged account helps with savings and wealth building. |

Both policies have their advantages, but there are some drawbacks to consider.

| Term Life Insurance | Whole Life Insurance |

| Limited length of coverage: The lower premium is driven by the fact that these policies expire – and they cost more with each renewal. | Higher price: Whole life insurance is among the highest premium among all the policy types. |

| Health is a major risk factor: The best rates are reserved for the young and healthy. If you are older or in poor health, you may need to pay more for a simplified or guaranteed issue policy. | Complicated: There are many factors you must know and understand to make this policy work for you, including the MTAR rules and how/when to leverage the cash savings. |

| Ease of access: Why would this be a drawback? Since you can quickly get term insurance online or even over the phone, many skip using an agent or broker. That means they also miss out on having an in-depth needs assessment done, resulting in better, more tailored coverage; riders; and extra considerations such as long-term care insurance.

|

Accessibly: As a complicated policy, it takes time to set up. If you need insurance fast (for a mortgage, etc.) know that this policy takes longer to get in force than term. |

The truth is, no one policy is better than the other. It all depends on your situation and needs. An insurance professional will consider your finances, debts, long-term goals, health and family health history, etc., before recommending term or whole life insurance.

| Go for Term Life Insurance if… | Go for Whole Life Insurance if… |

|

|

|

|

|

|

|

|

When talking about the costs of whole life insurance vs term life insurance, it is not necessarily an apples-to-apples comparison. Term life insurance will have a limited length of coverage and no cash accumulation component. Whole life insurance offers lifelong coverage and cash accumulation features.

To make numbers more comparable, we will look at the same amount of coverage for a term and whole life insurance policy: $300,000.

| Term Life Insurance | Whole Life Insurance | |

| 30 year-old male, non-smoker, no health preconditions |

$21 / month |

$155 / month |

| 40 year-old female, smoker, no health preconditions |

$62 / month |

$213 / month |

| 50 year-old male, non-smoker, no health preconditions |

$83 / month |

$390 / month |

| 60 year-old female, smoker, no health preconditions |

$346 / month |

$565 / month |

Whole life insurance is more expensive than term, but remember – it holds a lot of extra value. You are saving cash, your premiums never go up, and the policy does not expire.

|

Smoking is considered a big risk whether you are seeking term or whole life insurance. Expect to pay higher rates – sometimes even double – if you are an active smoker. If you quit and have remained a non-smoker for a number of months (your insurer can tell you how many are needed for non-smoker rates) be sure to update your insurance company. |

Expert tip from Ed Duggan “Whole Life insurance helps to address a long-term need. This could be to fund final expenses so that your family is not burdened by your end of life costs such as burial or cremation expenses, lawyer and executor fees, taxes, inheritance, and any other funds associated with a celebration of your life. A whole life policy with a fixed premium that does not increase as you get older provides tremendous peace of mind for you and your loved ones. Term life insurance being less expensive that Whole Life insurance, is a very cost-effective solution to provide financial security for your family for liabilities such as a mortgage or line of credit. Additionally, term insurance provides security for young families so that the children, while young and vulnerable, will not be adversely affected financially should something happen to one of the parents.” |

Smoking is considered a big risk whether you are seeking term or whole life insurance. Expect to pay higher rates – sometimes even double – if you are an active smoker. If you quit and have remained a non-smoker for a number of months (your insurer can tell you how many are needed for non-smoker rates) be sure to update your insurance company.

“Whole Life insurance helps to address a long-term need. This could be to fund final expenses so that your family is not burdened by your end of life costs such as burial or cremation expenses, lawyer and executor fees, taxes, inheritance, and any other funds associated with a celebration of your life. A whole life policy with a fixed premium that does not increase as you get older provides tremendous peace of mind for you and your loved ones.

Term life insurance being less expensive that Whole Life insurance, is a very cost-effective solution to provide financial security for your family for liabilities such as a mortgage or line of credit. Additionally, term insurance provides security for young families so that the children, while young and vulnerable, will not be adversely affected financially should something happen to one of the parents.”

It’s very easy to get term life insurance. It is offered by life insurance companies, agents, brokers, banks, online and over the phone. Bank insurance is usually debt insurance to cover a loan or mortgage, and the bank is the primary beneficiary.

Whole life insurance is available from larger/long-term established insurers, brokers, and agents. Due to the nature of this policy, always work directly with an insurance professional to set it up.

Since whole life insurance’s premiums are higher with age, seniors may want to consider a simplified or guaranteed issue term product to help manage rates. However, a broker can shop the market on the senior’s behalf and provide a comparison of the policies along with advice, empowering the senior to make a decision in their best interest.

Whole life insurance is not the only option for coverage that never expires.

Universal life insurance is cheaper than whole life. This is because it has a min/max range for the premium, enabling you to contribute just the cost of insurance on some months and extra on other months. The extra goes into the cash savings account. With universal life, the savings are not guaranteed – another reason why this policy cost less than whole life. The cash is more readily accessible, however, and these policies have a very solid performance history.

Term 100 covers you to age 100 with pure insurance. While there is no cash investment component, the premiums do not increase and there is no need to renew.