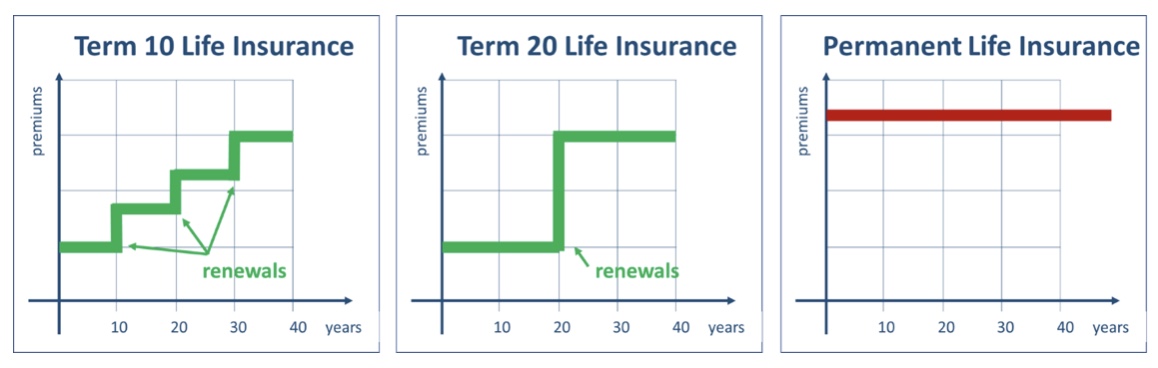

Life insurance policies can be split into two types of plans.

Term Life Insurance has lower initial rates, but the premiums increase over time (see the pic below). These plans generally do not build a cash value

Permanent life insurance, has higher initial premiums but the cost is generally level (see the pic below) and offers a variety of cash accumulation options.

We have collected the most frequent questions related to cash accumulation by life insurance policies. Please enjoy the information below and let us know if you have additional questions.

|

Most permanent life insurance policies build a cash value. The reason behind this is that traditional permanent policies have a level premium that spans the insured’s lifetime. The insured is paying a higher premium in the early policy years, and in return, their premiums remain level throughout their lifetime. Traditionally, this extra premium was held in the form of a guaranteed cash value, which the insured could access via a policy loan or surrender. There are several types of permanent life insurance policies:

|

Expert tip from Leslie Gottlieb “Cash value life insurance can be a great addition to your overall financial plan, depending on your objectives and circumstances. It can be a smart choice for long-term or lifelong coverage, dealing with estate taxes and costs, or creating a tax-exempt retirement income that has a low-risk investment profile. Before settling on a decision, make sure to compare the premiums, cash accumulation rate, and death benefits of various policies. Most importantly, ensure that all your questions have been answered to your satisfaction and that you fully understand the illustration provided.” |

Here is a quick comparison of all major life insurance types:

| Insurance policy… | Term Life Insurance | Whole Life Insurance, Non-Participating | Whole Life Insurance, Participating | Universal life Insurance | Term 100 Life Insurance |

|---|---|---|---|---|---|

| … considered a Permanent Life Insurance | No | Yes | Yes | Yes | Yes |

| … provides protection if you die | Yes | Yes | Yes | Yes | Yes |

| … accumulates cash value | No | Yes | Yes | Yes | Sometimes |

| … allows you to adjust the premiums you pay | No | No | No | Yes | No |

| … offers a stable level of premiums | Increases with age if you get a new term policy | Constant | Constant | You can adjust | Constant |

| … requires you to pay premiums | During the term duration, e.g. Term 20 – for 20 years | Lifelong | Lifelong | Lifelong | Until you are 100 (basically, lifelong) |

| … pays annual dividends | No | No | Yes | No | No |

| Policy costs | Very low at the beginning but can sharply increase towards the end of your life | High | High | Can vary depending on your decisions | In most instances lower than other Permanent policies |

|

The cash value of a life insurance policy is value that your policy has accumulated since the policy issue date. The policy owner can often access this value via the surrender of the policy, a loan or partial withdraw. Note that not all policies offer all the access to cash options, so the policy contract needs to be consulted. The cash value within a permanent or whole life policy is often broken down into two parts: the guaranteed cash value and the dividend cash value.

The amount available via loan and loan interest rate formulas varies from company to company and even contract to contract, so make sure you understand your policy. |

Expert tip from Ayal Alalouf “There are Several things to consider when owing a Participating (PAR) policy such as:

|

The cash surrender value of life insurance is basically the same as the cash value of a life insurance policy. It is an amount that an insurance company pays when you decide to “surrender” your insurance policy back to the insurance company. In this context, “surrender” is another word for terminate or return. Thus, it is a cash value that your policy has accumulated since its inception.

Buyer beware – certain policies have policy fees and surrender charges. This amount will be deducted from the cash you receive. Also, be aware of any potential taxable gains. If you have questions, be sure to ask and get your answers in writing.

The cash value of your insurance is typically shown on your statement together with your surrender cash value.

The cash value of your insurance is typically shown on your statement together with your surrender cash value.

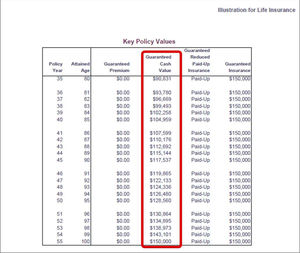

An example on the left illustrates where you should be searching for this value in your policy. A section called guaranteed cash value highlights the amount your policy has accumulated over time.

If you are not sure about the number, your insurance company or insurance broker should be able to provide this figure. Make sure you get it in writing.

The cash value in term life insurance is generally zero since traditional term insurance does not have a cash accumulation component.

Cashing out life insurance is easy – you will need to let your insurance company know that you want to surrender your policy. It is important to know, though, that before you do that, you should read all the details of your policy to understand the financial consequences and, in particular, what will be your “net surrender cash value,” inclusive of any fees. For whole life policies, consider surrendering after the annual dividend has been declared, otherwise you may be leaving money on the table.

Buyer beware – Be aware of any potential tax consequences from the surrender of your policy and review your life insurance needs with a qualified life insurance broker first.

Most cash value policies have a policy loan feature. The insurance company is essentially letting you borrow this value while keeping the policy in force. But this comes at price; each insurance company and each policy contract has a stipulated interest rate. Be sure to verify what that is.

Please see an example on the left of a policy statement that also includes a loan.

Buyer Beware – If your loan value escalates beyond a certain point (often 90 per cent), the policy can terminate because the loan intertest rate is typically higher than the dividend paid with whole life policies.

That’s where you should be really careful. It is EXTREMELY important to know that, if you die, depending on the type of policy:

If you want to cancel your cash value life insurance, it basically means that you are “surrendering” it. There will be a net amount that you will receive when cancelling, called the surrender value. This takes into account any fees or surrender charges. This amount does not factor into any taxable gains which may apply. Buyer Beware – many Permanent life insurance policies have surrender penalties on the cash value some extending as long as 15 years. It is linked to the cash value your policy has accumulated over time.