Life insurance for seniors are life insurance policies that allow people of senior age, who often have a number of pre-existing medical conditions, to still qualify.

In most situations, the coverage required by seniors is not very extensive since it serves the purpose of covering outstanding debts and final expenses rather than supporting others.

There are several types of life insurance for seniors that we will review below in more detail.

Lorne Marr from LSM Insurance shares his experience:

“Seniors are needing life insurance more than ever and in Canada there is an increase in an amount of debt that a lot of seniors have and more people are carrying a mortgage into their later years so that puts a stronger emphasis on life insurance for seniors.

Now, if seniors are looking into life insurance, they gonna wanna decide if they want a traditional life insurance policy where it is fully underwritten or a simplified issue type policy where there are no medical tests and series of health questions. They also gonna wanna decide if they want Term Insurance where the rates start off lower and go up as you get older or if they want a permanent policy where they start off a bit higher but never get up as you get older.

When you looking into your life insurance, you gonna wanna work with an independent broker who can find you the best deal and the best plan for your particular situation.”

Seniors’ life insurance, if you are not looking for huge coverage, is quite affordable, especially if you can qualify for more cost efficient insurance types.

Your age matters though – while you are 60 or 65 you can easily qualify for much cheaper insurance policies which will not be available to you if you are 80 ore 85.

Even though many seniors no longer have dependents, life insurance can still play an important role. It can help cover funeral and burial costs, outstanding debts such as credit cards or small loans, medical expenses not covered by provincial plans, or even leave a small inheritance for children or grandchildren. For some, it also provides peace of mind knowing loved ones won’t face financial stress after their passing.

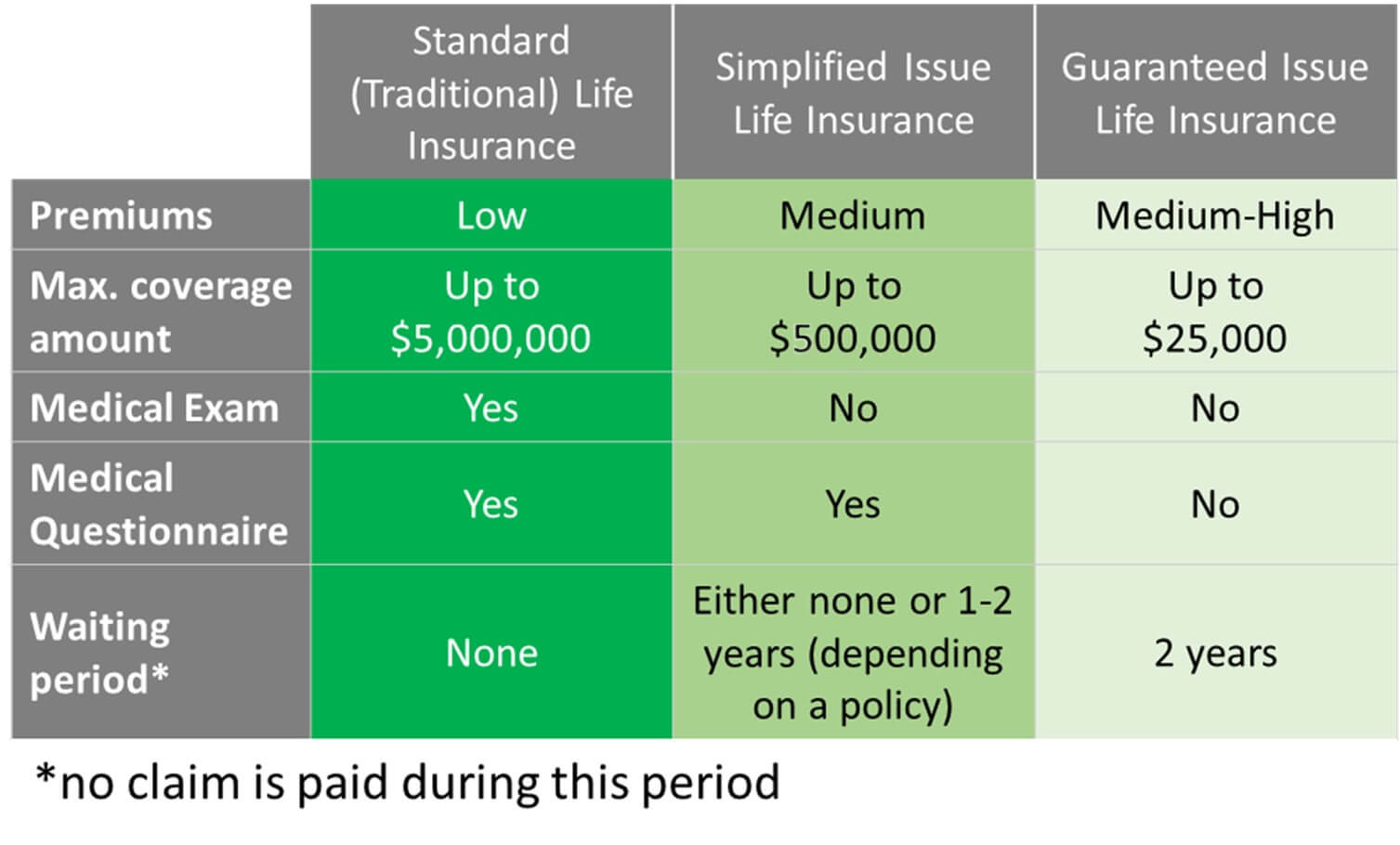

Life insurance for seniors comes in three major shapes and forms: Standard (also called Traditional Life Insurance), Simplified Issue Life Insurance, and Guaranteed Issue Life Insurance.

“Young” seniors aged 60-65 can easily qualify for standard life insurance for seniors, whereas if you are in your 70’s or 80’s you might need to go for a Simplified Issue Life Insurance for Seniors, or Guaranteed Issue Life Insurance.

There are two major types of life insurance for seniors with no medical exam:

Guaranteed Issue Life Insurance (also called Guaranteed Life Insurance) has nearly zero hurdles to get a policy but it would cost you more for the same amount of coverage as Simplified Issue Life Insurance.

Life insurance rates for seniors depend on several factors, including age, gender, smoking status, health conditions, coverage amount, and policy type. For example, a 65-year-old non-smoker in good health can still access relatively affordable premiums, while someone with multiple chronic conditions or a history of serious illness may face higher costs or need to choose a simplified or guaranteed issue policy.

Even at an older age, there are strategies to lower premiums. Comparing quotes from multiple insurers, opting for smaller coverage amounts, and maintaining a healthy lifestyle all help. Some providers offer discounts for non-smokers, or for seniors who pay annually instead of monthly. Working with an independent broker who specializes in senior life insurance ensures you don’t overpay and helps identify lesser-known insurers offering competitive rates.

Life insurance for seniors over 60 in Canada offers a broad array of options, especially if you’re just above 60. Both fully underwritten and no medical life insurance products are at your disposal. You can qualify for both Term 10 and Term 20 coverage at standard rates. If you’re in excellent health and have a good family health history, you could even qualify for preferred rates. Traditional fully underwritten plans offer higher face amounts, but they do require a more extensive health questionnaire and medical tests. However, if you’re in good health, a traditional fully underwritten Term 10 or Term 20 plan is a better value than a no medical life insurance plan, as you will qualify for higher face amounts and lower premiums.

If you’re just a bit over 70, you still have a variety of life insurance options. A few traditional fully underwritten plans and a wide range of no medical life insurance products are available to you. Most carriers offer Term 10 policies, and some may offer a Term 20 policy if you’re in relatively good health. Pricing for Term 10 and no medical life insurance products can vary, so it’s beneficial to work with an independent broker familiar with this market to ensure you get the best plan and rate. If you’re thinking mostly about covering final expenses, we have extensive guidance on this topic.

For seniors over 75 in Canada, there are still some insurance options to choose from. Mostly, no medical life insurance products are available, although some carriers may offer a fully underwritten Term 10 policy. Face amounts will be more limited, especially with no medical plans, but you can combine coverages with multiple carriers to increase the total coverage amount. A bonus is that you generally won’t need to worry about complex application questionnaires, but rather answer a few simple questions to qualify for no medical life insurance (simplified issue life insurance) or no questions asked at all for a guaranteed life insurance. If you’re thinking mostly about covering final expenses, we have extensive guidance on this topic as well.

If you are over 80 years old, insurance companies typically treat you a bit differently than younger seniors. As a rule, some life insurance policies such as traditional term life insurance policies will not be available to you.

At the same time, there are several avenues that are open to you in the form of no medical life insurance. You are often able to qualify for guaranteed issue life insurance (also called guaranteed life insurance) policies and, in some cases can also qualify for a simplified issue life insurance policy. Our insurance specialists can find you a tailored life insurance plan for seniors.

As you age, your insurance needs may change. Some seniors decide to reduce coverage once debts are repaid or funeral costs are pre-funded. Others might switch from term to permanent coverage to ensure lifetime protection. Reviewing your policy every few years—or after major life changes like retirement, home sale, or spouse’s passing—can prevent paying for coverage you no longer need.

Life insurance can also serve as a useful estate planning tool. The death benefit can help equalize inheritance between heirs (e.g., one child inherits a business, another receives life insurance proceeds) or cover estate taxes and legal costs. Some seniors also use permanent life insurance with a cash value component to grow tax-deferred savings that can be accessed later in life. Find out more about it in our guide High Net Worth Life Insurance Strategies.