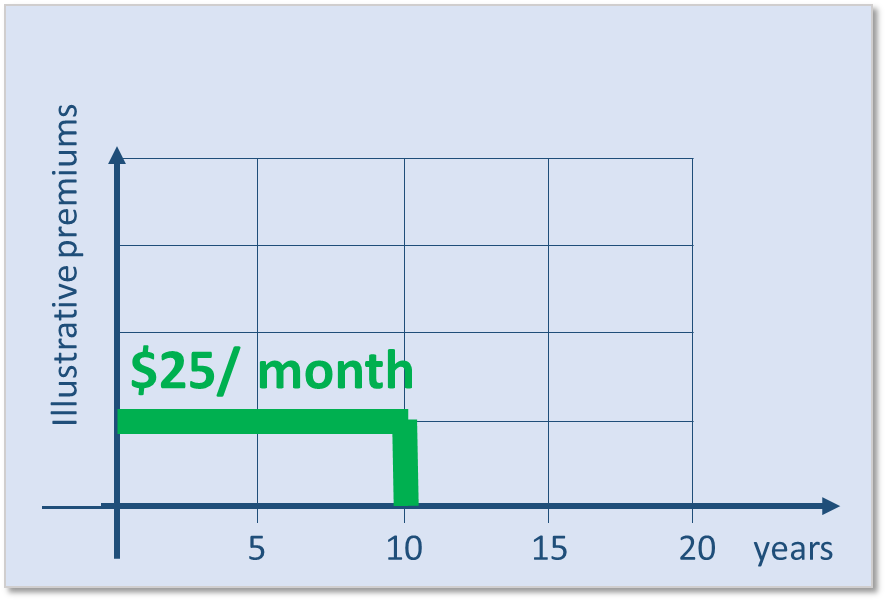

Term 10 life insurance is a sub-category of Term life insurance. It covers a policyholder for a clearly defined term of 10 years (thus, it is called Term 10). Should a policy holder pass away within this time frame, his/her beneficiaries will receive the coverage amount. After 10 years, this policy comes to an end (coverage disappears). A picture below shows a sample premium structure.

If you want to extend a 10-year term life insurance policy, most likely, your insurance company will require you to get another quote. The new term life insurance policy will be typically more expensive because life insurance rates become higher as you get older (see an example below).

“Term 10 policies are term insurance policies where the premiums are level for 10 years. This type of term policies are generally the least expensive initially because the cost is only level for 10-year-period. It can be ideal for a short business loan, if you have a line of credit, if you have a very short term mortgage. It gives you a very affordable cost of insurance that you have in place that pays out tax-free to cover those obligations.

When looking for a Term 10 policy, you gonna wanna work with an independent broker who can find you the best possible premium.”

10 year level term life insurance, or Term 10 Life Insurance, provides a coverage for 10 years only and is optimal in particular situations. Here are a few examples:

Here is a brief comparison of how 10 year term life insurance compares to whole life insurance and universal life insurance

| 10 Year Term Life Insurance | Whole Life Insurance | Universal Life Insurance | |

| Coverage length | 10 year coverage | Life long | Life long |

| Insurance coverage | Yes | Yes | Yes |

| Cash accumulation | No | Yes | Yes |

| Can choose amounts going into insurance and cash accumulation | No | No | Yes |

| Pricing | Lower than Whole Life and Universal Life | More expensive than Term Life | More expensive than Term Life |

Below are a few examples of 10-year term life insurance rates/quotes. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g. based on your health condition).

Male, 29 years old, 10 Year Life Insurance Term, Non-Smoker, coverage amount $250,000

Female, 36 years old, 10 Year Life Insurance Term, Non-Smoker, coverage amount $400,000

Female 47 years old, 10 Year Life Insurance Term, Non-Smoker, coverage amount $350,000

The insurance rates presented are effective as of July 2025.

Please find below a few examples of 10- and 20-year term life insurance quotes for $500,000 coverage. It is important to remember that any life insurance quote depends on multiple factors and may vary from person to person (e.g., based on health condition).

| 10 Year Term Life Insurance rates | 20 Year Term Life Insurance rates | |

| Male, 30 years old, non-smoker | $20 / month | $29 / month |

| Female, 30 years old, non-smoker | $14 / month | $20 / month |

| Male, 50 years old, non-smoker | $61 / month | $121/ month |

| Female, 50 years old, non-smoker | $45 / month | $81 / month |

The insurance rates presented are effective as of July 2025.

Nearly every insurance company offers 10-year term life insurance policies, and, in most cases, the pricing is very competitive. We work with many of these companies and can provide access to providers such as Canada Life, Empire Life, Ivari, RBC Insurance, La Capitale, Canada Protection Plan, Wawanesa Insurance, Assumption Life, SSQ Financial Group, Industrial Alliance, Equitable Life, Foresters, Desjardins Insurance, BMO Life Insurance, and many more.